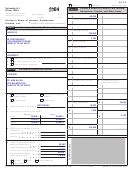

6511

Final K-1

Amended K-1

OMB No. 1545-0099

Schedule K-1

2004

Partner’s Share of Current Year Income,

Part III

(Form 1065)

Deductions, Credits, and Other Items

1

Ordinary business income (loss)

15 Credits & credit recapture

Department of the Treasury

Tax year beginning

2004

Internal Revenue Service

89,490

and ending

2004

20

2

Net rental real estate income (loss)

Partner’s Share of Income, Deductions,

Credits, etc.

See back of form and separate instructions.

3

Other net rental income (loss)

16 Foreign transactions

Part I

Information About the Partnership

A

Partnership’s employer identification number

4

Guaranteed payments

564325619

135,000

B

Partnership’s name, address, city, state, and ZIP code

5

Interest income

2,185

AB PARTNERSHIP

1350 UNIVERSITY ROAD

6a Ordinary dividends

CHARLOTTE, NC 28223

6b Qualified dividends

C

IRS Center where partnership filed return

7

Royalties

CINCINNATI

8

Net short-term capital gain (loss)

D

Check if this is a publicly traded partnership (PTP)

E

Tax shelter registration number, if any

9a Net long-term capital gain (loss)

17 Alternative minimum tax (AMT) items

F

Check if Form 8271 is attached

9b Collectibles (28%) gain (loss)

Part II

Information About the Partner

G

Partner’s identifying number

372184389

9c Unrecaptured section 1250 gain

H

Partner’s name, address, city, state, and ZIP code

18 Tax-exempt income and

DR. ANN ALLEN

10

Net section 1231 gain (loss)

nondeductible expenses

8375 BELMONT RD

CHARLOTTE, NC 28209

11

Other income (loss)

I

General partner or LLC

Limited partner or other LLC

member-manager

member

19 Distributions

J

Domestic partner

Foreign partner

50,000

A

12

Section 179 deduction

INDIVIDUAL

10,222

K

What type of entity is this partner?

13

Other deductions

A

1,000

20 Other information

L

Partner’s share of profit, loss, and capital:

Beginning

Ending

2,185

A

50.000

50.000

Profit

%

%

50.000

50.000

Loss

%

%

50.000

50.000

Capital

%

%

14

Self-employment earnings (loss)

A

214,268

M

Partner’s share of liabilities at year end:

Nonrecourse

$

Qualified nonrecourse financing

$

*See attached statement for additional information.

1,140

Recourse

$

N

Partner’s capital account analysis:

82,395

Beginning capital account

$

Capital contributed during the year

$

86,215

Current year increase (decrease)

$

(

50,000

)

Withdrawals & distributions

$

118,610

Ending capital account

$

Tax basis

GAAP

Section 704(b) book

Other (explain)

For Privacy Act and Paperwork Reduction Act Notice, see Instructions for Form 1065.

Cat. No. 11394R

Schedule K-1 (Form 1065) 2004

1

1 2

2