Form 1040me - Maine Individual Income Tax Booklet - 2012 Page 11

ADVERTISEMENT

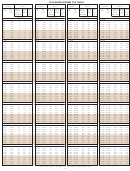

ITEMIZED DEDUCTIONS

SCHEDULE 2

FORM 1040ME

2012

99

Enclose with your Form 1040ME

Attachment

For more information, visit

1

*1202204*

Sequence No.

Name(s) as shown on Form 1040ME

Your Social Security Number

SCHEDULE 2 — ITEMIZED DEDUCTIONS - For Form 1040ME, line 17

.00

4

Total itemized deductions from federal Form 1040, Schedule A, line 29 ...................................... 4

5

a

Income taxes imposed by this state or any other taxing jurisdiction or general sales

.00

taxes included in line 4 above from federal Form 1040, Schedule A, line 5 ............................ 5a

b

Deductible costs, included in line 4 above, incurred in the production of

.00

.......................................................................................................... 5b

Maine exempt income

c

Amounts included in line 4 that are also being claimed for the Family Development

.00

Account Credit on Maine Schedule A, line 18 ...................................................................... 5c

d

Amount included in line 4 attributable to income from an ownership interest in a

.00

pass-through entity fi nancial institution ................................................................................ 5d

6

Deductible costs of producing income exempt from federal income tax, but taxable by

.00

Maine ............................................................................................................................................ 6

.00

7

Line 4 minus lines 5a, b, c, and d plus line 6. Enter result here and on 1040ME, page 1, line 17 ...... 7

*NOTE: If the amount on line 7 above is less than your allowable standard deduction, use the standard deduction.

If Married Filing Separately, however, both spouses must either itemize or use the standard deduction.

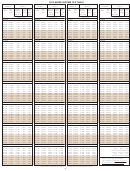

SCHEDULE 2 — ITEMIZED DEDUCTIONS — See page 19

Line 4. Total Itemized Deductions. Federal Form 1040. Enter your total itemized deductions as shown on federal Schedule A, line 29.

Line 5a. Income Taxes Imposed by this State or any other taxing Jurisdiction or General Sales Taxes included in Line 4. Enter the total of state

and local income taxes or sales taxes included in line 4.

Line 5b. Deductible costs, included in Line 4, incurred in the production of Maine exempt income. Enter any interest or other expense items

attributable to income not taxable under Maine law.

Line 6. Deductible costs of producing income exempt from federal income tax but taxable by Maine. Enter any interest or other expense items

o

attributable to income taxable under Maine law, but exempt from federal income tax. Enter

nly amounts not included on line 4.

11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20