Form 1040me - Maine Individual Income Tax Booklet - 2012 Page 6

ADVERTISEMENT

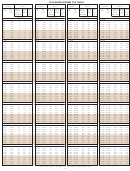

2012

1040ME LONG FORM

Page 2

99

*1202101*

.00

21

TAX ADDITIONS. (From Maine Schedule A, line 3.) ...........................................

21

22

LOW-INCOME TAX CREDIT. (See instructions.) NOTE: You must

.00

fi le a return only if you are claiming a refund.) .....................................................

22

.00

23

TOTAL TAX. (Line 20 plus line 21 minus line 22.) ................................................

23

.00

24

TAX CREDITS. (From Maine Schedule A, line 21.) ..............................................

24

25

NONRESIDENT CREDIT. (For part-year residents, nonresidents and

.00

“Safe Harbor” residents only.) From Schedule NR, line 9 or NRH, line 11 ...........

25

(You MUST attach a copy of your federal return and/or TDY papers.)

.00

26

NET TAX. (Subtract lines 24 and 25 from line 23.) (Nonresidents see instructions.)..

26

27 TAX PAYMENTS.

.00

a Maine Income Tax Withheld. (Enclose W-2, 1099 and 1099ME forms) ........

27a

b 2012 Estimated Tax Payments and 2011 Credit Carried Forward and Extension

.00

payment. (Include any REAL ESTATE WITHHOLDING Tax Payments.) ................

27b

REFUNDABLE TAX CREDITS. Enclose applicable worksheet with your return.

.00

c. Rehabilitation of historic properties after 2007 (worksheet, line 6) .......................

27c

.00

d. Child care credit. (Child Care Credit worksheet, line 5.) ......................................

27d

.00

e. TOTAL (Add lines 27a, b, c and d.) ......................................................................

27e

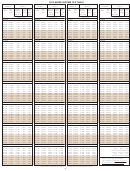

28

INCOME TAX OVERPAID. If line 27e is larger than line 26, enter amount

overpaid (Line 27e minus line 26.) ........................................................................

28

.00

29

INCOME TAX UNDERPAID. If line 26 is larger than line 27e, enter amount

underpaid (Line 26 minus line 27e.) ......................................................................

29

.00

30

USE TAX (SALES TAX). (See instructions.) .........................................................

30

.00

.00

30a SALES TAX ON CASUAL RENTALS OF LIVING QUARTERS. (See instructions.) .....

30a

.00

31

CHARITABLE CONTRIBUTIONS and PARK PASSES. (From Maine Schedule CP, line 12.)

31

32

NET OVERPAYMENT. (Line 28 minus lines 30, 30a and 31.) – NOTE: If total of

.00

lines 30, 30a and 31 is greater than line 28, enter as amount due on line 34a below 32

33

Amount to be CREDITED

.00

.00

REFUND

to 2013 estimated tax ... 33a

33b

IF YOU WOULD LIKE YOUR REFUND SENT DIRECTLY TO YOUR BANK ACCOUNT ($10,000 or less) OR TO A NEXTGEN COLLEGE INVESTING

PLAN ® ACCOUNT, see the instructions on page 3 and fi ll in the lines below.

Check here if this refund

33c

Routing Number*

will go to an account

outside the United

States. ........................

33d

Account Number*

*For NextGen Accounts, enter 043000261 on line 33c and the account owner’s 9-digit social security number on line 33d (do not enter hyphens).

NextGen ®

33e Type of Account:

Checking

Savings

34 a TAX DUE. (Add lines 29, 30, 30a and 31) - NOTE: If total of lines 30, 30a and

.00

31 is greater than line 28, enter the difference as an amount due on this line...

34a

b Underpayment Penalty. (Attach Form 2210ME.)

.00

Check here if you checked the box on Form 2210, line 17

............

34b

.00

c TOTAL AMOUNT DUE. (Add lines 34a and 34b.) (Pay in full with return.) .......

34c

EZ PAY at or ENCLOSE CHECK payable to: Treasurer, State of Maine. DO NOT SEND CASH

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20