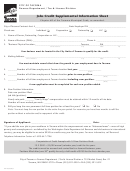

Supplemental Information Sheet - Abdc

ADVERTISEMENT

Supplemental Information Sheet

Tax Year : 20

version 10-14

Are you a member of a

Federally-recognized

Indian tribe?

Taxpayer Social Security Number

Taxpayer Name Per Social Security Card

Yes No

Taxpayer

Yes No

Spouse

Spouse Social Security Number

Spouse Name Per Social Security Card

If

Yes

Can you be claimed as a dependent

Dependents do not take

YES

No

on another persons return?

your own exemption

→

Name of Person Who can Claim You

Social Security # (if known )

Relationship

Did you or your spouse

Yes No

Yes No

Yes No

a. Receive the Alaska PFD?

c. Receive commercial fishing income?

e. Receive a Form 1099-MISC?

Yes No

Yes No

b. Have the Alaska PFD taken away?

d. Receive a native/corporation dividend?

If Yes, what was done to earn this income?

If Yes, please list the corporation:

To claim Head of Household filing status you must be either Single or Married Filing a Separate return and have lived apart from your spouse for the last six months of the year. You must have a

qualifying dependent. Only one person in the home can be Head of Household. Ask your preparer for details.

Yes No

If you are single or MFS and qualify, did you pay more than half the cost of keeping up the home for yourself and a qualifying dependent?

List all dependents. You may be able to claim a dependent as a qualifying child or as a qualifying relative. You may be able to claim a person that is not related to you if the person lived with you

for the entire year and made less than the personal exemption amount and you provided for more than half of their support. You may be able to claim your child that is over 18. Make sure that the

person that you claim as a dependent does not claim themself on their own return. Ask your preparer and check out the dependency brochure.

Receive

Did you

Dependents Full Name

US

Number of

the AK

provide

Citizen,

Is the Dependent a

Did this person have income

Must match Social Security card

Dependents

months

Full time

PFD last

over 50%

Resident

member of a

other than the PFD,

-------

Birth Date

Legal

dependent

Student

year?

of the

Age

Social Security Number

of US,

Federally-recognized

such as Wages, Self

(List youngest to oldest)

Relationship

lived with

last year

(Yes/No)

(mm/dd/yy)

support for

Canada or

Indian Tribe

employment, Native/Corp

-------

to You

you last

(Yes/No)

If

this

Mexico

(Yes/No)

dividends, Social Security, etc?

Do not enter your name or your

year

garnishied

dependent

(Yes/No)

spouses name below.

still yes.

(Yes/No)

st

Yes No

Were any of the dependents married as of December 31

or can anyone else claim the dependents on their tax return?

Preparer Complete Grey Area

Yes No

Does anyone else live in the home?

Preparer

Yes No

If you are due a refund would you like direct deposit?

If yes, Bank

Account Number

Checking or Savings

Site

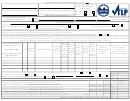

TAXPAYER SPREADSHEET FISHING QUESTIONS (TAX PREPARERS COMPLETE GREY AREA)

Taxpayer

Spouse

Combined Date

Form 1099 MISC

1. Do you or your spouse own a commercial fishing Limited Entry Permit issued by the State of Alaska? These permits may be issued

for salmon, herring, crab or other types of finfish or shellfish. Please answer Yes or No.

Information

If YES, then stop; if NO then go to questions 2.

Payer

2. Do you or your spouse own IFQ shares (Individual Fishing Quota)? Please answer Yes or No.

Amount

If YES, then stop; if NO then go to questions 3.

Box

3. Are you or your spouse a commercial fishing captain or crewmember? Please answer Yes or No.

Payer

Preparers: The individual total should not be more than 1. The combined total should not be more that 2.

Totals

Amount

Preparers: use the combined totals to complete the Taxpayer Spreadsheet.

Box

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1