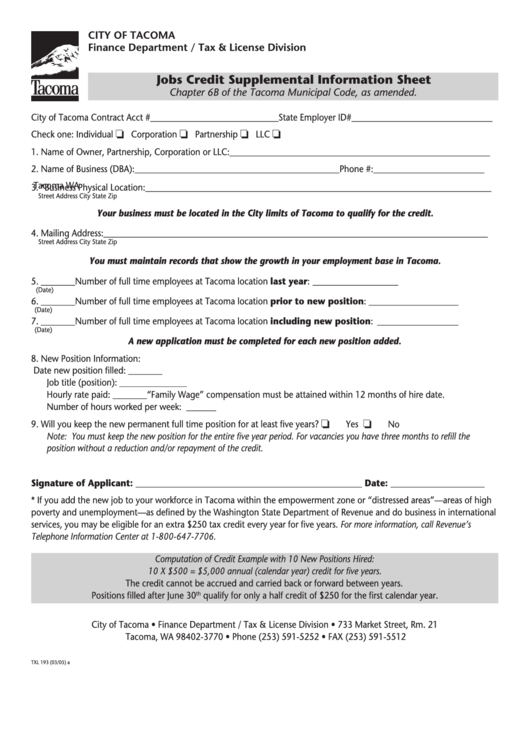

Form Txl 193 - Jobs Credit Supplemental Information Sheet - City Of Tacoma

ADVERTISEMENT

CITY OF TACOMA

Finance Department / Tax & License Division

Jobs Credit Supplemental Information Sheet

Chapter 6B of the Tacoma Municipal Code, as amended.

City of Tacoma Contract Acct # ______________________________State Employer ID# _________________________________

Check one:

Individual

❏

Corporation

❏

Partnership

❏

LLC

❏

1. Name of Owner, Partnership, Corporation or LLC: _____________________________________________________________

2. Name of Business (DBA): ________________________________________________ Phone #: __________________________

Tacoma

WA

3. *Business Physical Location:_________________________________________________________________________________

Street Address

City

State

Zip

Your business must be located in the City limits of Tacoma to qualify for the credit.

4. Mailing Address: __________________________________________________________________________________________

Street Address

City

State

Zip

You must maintain records that show the growth in your employment base in Tacoma.

5. ________Number of full time employees at Tacoma location last year: ____________________

(Date)

6. ________Number of full time employees at Tacoma location prior to new position: _____________________

(Date)

7. ________Number of full time employees at Tacoma location including new position: ___________________

(Date)

A new application must be completed for each new position added.

8. New Position Information:

Date new position filled: ________

Job title (position):

Hourly rate paid: ________“Family Wage” compensation must be attained within 12 months of hire date.

Number of hours worked per week: _______

9. Will you keep the new permanent full time position for at least five years?

❏

Yes

❏

No

Note: You must keep the new position for the entire five year period. For vacancies you have three months to refill the

position without a reduction and/or repayment of the credit.

Signature of Applicant: _____________________________________________________ Date: ______________________

* If you add the new job to your workforce in Tacoma within the empowerment zone or “distressed areas”—areas of high

poverty and unemployment—as defined by the Washington State Department of Revenue and do business in international

services, you may be eligible for an extra $250 tax credit every year for five years. For more information, call Revenue’s

Telephone Information Center at 1-800-647-7706.

Computation of Credit Example with 10 New Positions Hired:

10 X $500 = $5,000 annual (calendar year) credit for five years.

The credit cannot be accrued and carried back or forward between years.

Positions filled after June 30

qualify for only a half credit of $250 for the first calendar year.

th

City of Tacoma • Finance Department / Tax & License Division • 733 Market Street, Rm. 21

Tacoma, WA 98402-3770 • Phone (253) 591-5252 • FAX (253) 591-5512

TXL 193 (03/05) a

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1