Form Wt-4b - Certificate Of Exemption From Wisconsin Withholding For 2014 Based On The Working Families Tax Credit Page 2

ADVERTISEMENT

NEED ASSISTANCE?

If you have questions about the Working Families Tax Credit, or need assistance in completing the worksheet on page 1,

contact any Department of Revenue office. You may also call Madison at (608) 266-2776. If you prefer, you may write to:

Wisconsin Department of Revenue

PO Box 8949

Madison, WI 53708-8949

Email: DORwithholdingtax@revenue.wi.gov

CAUTION

If you claim exemption from the withholding of Wisconsin income tax from your wages and subsequent changes in your

income or marital status will result in your not being eligible for the Working Families Tax Credit, you must revoke the

exemption. To revoke the exemption, you must notify your employer to resume withholding Wisconsin income tax from

your wages. Use Wisconsin Form WT-4A to determine the amount your employer should withhold.

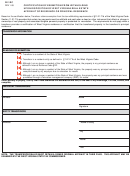

Detach here and give completed certificate to your employer, if you qualify.

FORM WT-4B

WISCONSIN

Certificate of Exemption From Wisconsin Withholding for 2014

DEPARTMENT

Based on the Working Families Tax Credit

OF REVENUE

(Expires on December 31, 2014)

Employee’s Full Name

Social Security Number

I CERTIFY that I will qualify for the Working Families Tax Credit for 2014 and claim exemption from withholding

of Wisconsin income tax from the wages I receive during 2014.

Signature of employee

Date

Employee: Give the completed certificate to your employer to claim exemption from having Wisconsin income tax withheld

from wages you receive during 2014.

Employer: After receiving this certificate, discontinue withholding Wisconsin income tax from wages you pay to this employee

during 2014. This certificate applies only to wages paid during 2014.

Note: It is not necessary to provide a copy of this certificate to the Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2