Tax Lien Release

ADVERTISEMENT

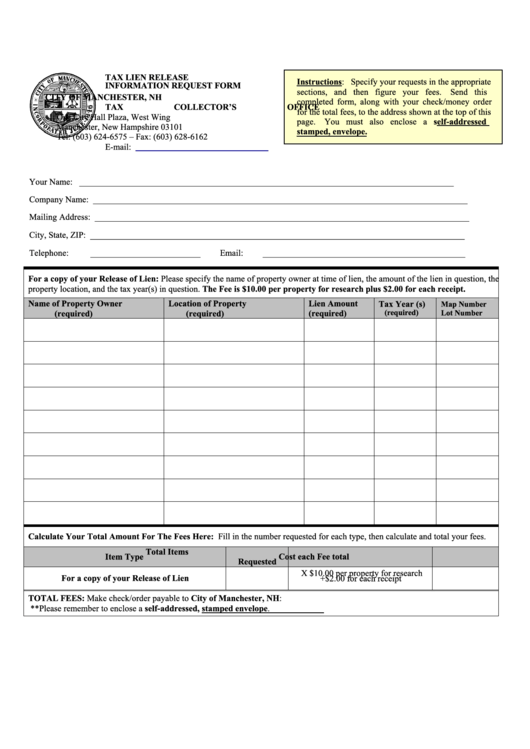

TAX LIEN RELEASE

Instructions: Specify your requests in the appropriate

INFORMATION REQUEST FORM

sections, and then figure your fees.

Send this

CITY OF MANCHESTER, NH

completed form, along with your check/money order

TAX COLLECTOR’S OFFICE

for the total fees, to the address shown at the top of this

One City Hall Plaza, West Wing

page.

You must also enclose a self-addressed

Manchester, New Hampshire 03101

stamped, envelope.

Tel: (603) 624-6575 – Fax: (603) 628-6162

taxcollector@manchesternh.gov

E-mail:

Your Name:

_____________________________________________________________________________________

Company Name:

_____________________________________________________________________________________

Mailing Address:

_____________________________________________________________________________________

City, State, ZIP:

_____________________________________________________________________________________

Telephone:

_________________________

Email:

______________________________________________

For a copy of your Release of Lien: Please specify the name of property owner at time of lien, the amount of the lien in question, the

property location, and the tax year(s) in question. The Fee is $10.00 per property for research plus $2.00 for each receipt.

Name of Property Owner

Location of Property

Lien Amount

Tax Year (s)

Map Number

(required)

(required)

(required)

Lot Number

(required)

Calculate Your Total Amount For The Fees Here: Fill in the number requested for each type, then calculate and total your fees.

Total Items

Item Type

Cost each

Fee total

Requested

X $10.00 per property for research

For a copy of your Release of Lien

+$2.00 for each receipt

TOTAL FEES: Make check/order payable to City of Manchester, NH:

**Please remember to enclose a self-addressed, stamped envelope.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1