Board Of Review Petition Page 2

Download a blank fillable Board Of Review Petition in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Board Of Review Petition with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

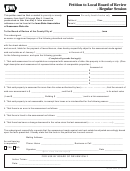

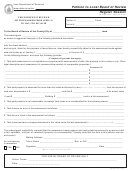

PROTEST OF ASSESSMENT TO LOCAL BOARD OF REVIEW

(References hereinafter are to Code of Iowa)

Section 441.37 Protest of assessment—grounds.

Any property owner or aggrieved taxpayer who is dissatisfied with the owner’s or taxpayer’s assessment may file a

protest against such assessment with the board of review on or after April 16, to and including May 5, of the year of the

assessment. In any county which has been declared to be a disaster area by proper federal authorities after March 1

and prior to May 20 of said year of assessment, the board of review shall be authorized to remain in session until June

15 and the time for filing a protest shall be extended to and include the period from May 25 to June 5 of such year. Said

protest shall be in writing and signed by the one protesting or by the protester’s duly authorized agent. The taxpayer

may have an oral hearing thereon if request therefore in writing is made at the time of filing the protest. Said protest

must be confined to one or more of the following grounds:

1. That said assessment is not equitable as compared with assessments of other like property in the taxing district.

When this ground is relied upon as the basis of a protest the legal description and assessments of a

representative number of comparable properties, as described by the aggrieved taxpayer shall be listed on the

protest, otherwise said protest shall not be considered on this ground.

2. That the property is assessed for more than the value authorized by law, stating the specific amount which the

protesting party believes the property to be overassessed, and the amount which the party considers to be its

actual value and the amount the party considers a fair assessment.

3. That the property is not assessable, is exempt from taxes, or is misclassified and stating the reasons for the

protest.

4. That there is an error in the assessment and state the specific alleged error.

5. That there is fraud in the assessment which shall by specifically stated.

In addition to the above, the property owner may protest annually to the board of review under the provisions of section 441.35, but

such protest shall be in the same manner and upon the same terms as heretofore prescribed in this section.

Section 441.21, provides that,

“The burden of proof shall be upon any complainant attacking such valuations as excessive, inadequate, inequitable or

capricious; however, in protest or appeal proceedings when the complainant offers competent evidence by at least two

disinterested witnesses that the market value of the property is less than the market value determined by the assessor,

the burden of proof thereafter shall be upon the officials or persons seeking to uphold such valuations to be assessed.”

Section 441.37A Appeal of protest to property assessment appeal board.

1. Appeals may be taken from the action of the board of review with reference to protests of assessment, valuation,

or application of an equalization order to the property assessment appeal board created in section 421.1A.

However, a property owner or aggrieved taxpayer or an appellant described in section 441.42 may bypass the

property assessment appeal board and appeal the decision of the local board of review to the district court

pursuant to section 441.38. For an appeal to the property assessment appeal board to be valid, written notice

must be filed with the secretary of the property assessment appeal board within twenty days after the date the

board of review’s letter of disposition of the appeal is postmarked to the party making the protest. The written

notice of appeal shall include a petition setting forth the basis of the appeal and the relief sought.

Section 441.38 Appeal to district court.

1. Appeals may be taken from the action of the board of review with reference to protests of assessments, to the

district court of the county in which the board holds its sessions within twenty days after its adjournment or May

31, whichever date is later. No new grounds in addition to those set out in the protest to the board of review as

provided in section 441.37 can be pleaded, but additional evidence to sustain those grounds may be introduced.

The assessor shall have the same right to appeal and in the same manner as an individual taxpayer, public body

or other public officer as provided in section 441.42. Appeals shall be taken by filing a written notice of appeal

with the clerk of district court. Filing of the written notice of appeal shall preserve all rights of appeal of the

appellant.

2. Notice of appeal shall be served as an original notice on the chairperson, presiding officer, or clerk of the board

of review after the filing of notice under subsection 1 with the clerk of district court.

Section 441.39 Trial on Appeal

1. If the appeal is from a decision of the local board of review, the court shall hear the appeal in equity and

determine anew all questions arising before the board which relate to the liability of the property to assessment

or the amount thereof. The court shall consider all of the evidence and there shall be no presumption as to

the correctness of the valuation or assessment appealed from. If the appeal is from a decision of the property

assessment appeal board, the court’s review shall be limited to the correction of errors at law.

56-064 (02/16/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2