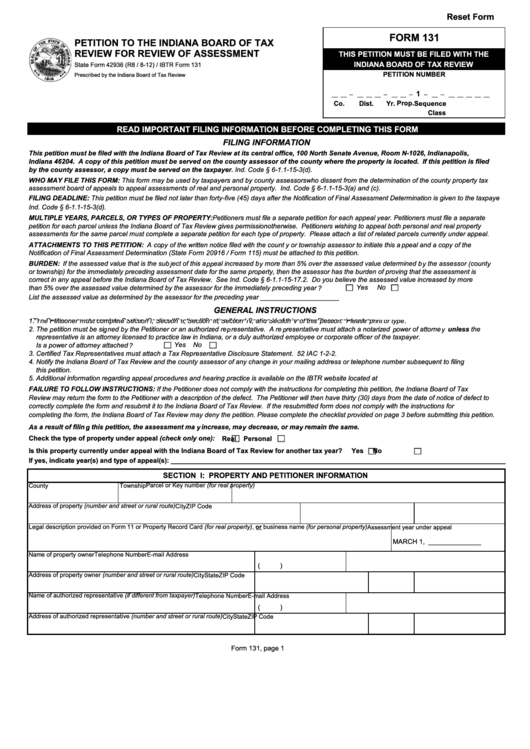

Reset Form

FORM 131

PETITION TO THE INDIANA BOARD OF TAX

REVIEW FOR REVIEW OF ASSESSMENT

THIS PETITION MUST BE FILED WITH THE

INDIANA BOARD OF TAX REVIEW

State Form 42936 (R8 / 8-12) / IBTR Form 131

PETITION NUMBER

Prescribed by the Indiana Board of Tax Review

1

__ __ -- __ __ __ -- __ __ --

-- __ -- __ __ __ __ __

Co.

Dist.

Yr.

Prop.

Sequence

Class

READ IMPORTANT FILING INFORMATION BEFORE COMPLETING THIS FORM

FILING INFORMATION

This petition must be filed with the Indiana Board of Tax Review at its central office, 100 North Senate Avenue, Room N-1026, Indianapolis,

Indiana 46204. A copy of this petition must be served on the county assessor of the county where the property is located. If this petition is filed

by the county assessor, a copy must be served on the taxpayer. Ind. Code § 6-1.1-15-3(d).

WHO MAY FILE THIS FORM: This form may be used by taxpayers and by county assessors who dissent from the determination of the county property tax

assessment board of appeals to appeal assessments of real and personal property. Ind. Code § 6-1.1-15-3(a) and (c).

FILING DEADLINE: This petition must be filed not later than forty-five (45) days after the Notification of Final Assessment Determination is given to the taxpaye

Ind. Code § 6-1.1-15-3(d).

MULTIPLE YEARS, PARCELS, OR TYPES OF PROPERTY: Petitioners must file a separate petition for each appeal year. Petitioners must file a separate

petition for each parcel unless the Indiana Board of Tax Review gives permission otherwise. Petitioners wishing to appeal both personal and real property

assessments for the same parcel must complete a separate petition for each type of property. Please attach a list of related parcels currently under appeal.

ATTACHMENTS TO THIS PETITION: A copy of the written notice filed with the county or township assessor to initiate this appeal and a copy of the

Notification of Final Assessment Determination (State Form 20916 / Form 115) must be attached to this petition.

BURDEN: If the assessed value that is the subject of this appeal increased by more than 5% over the assessed value determined by the assessor (county

or township) for the immediately preceding assessment date for the same property, then the assessor has the burden of proving that the assessment is

correct in any appeal before the Indiana Board of Tax Review. See Ind. Code § 6-1.1-15-17.2. Do you believe the assessed value increased by more

Yes

No

than 5% over the assessed value determined by the assessor for the immediately preceding year?

List the assessed value as determined by the assessor for the preceding year _____________________

GENERAL INSTRUCTIONS

1 The Petitioner must complete Section I Section II Section III Section IV and Section V of this petition Please print or type

1. The Petitioner must complete Section I, Section II, Section III, Section IV, and Section V of this petition. Please print or type.

2. The petition must be signed by the Petitioner or an authorized representative. A representative must attach a notarized power of attorney unless the

representative is an attorney licensed to practice law in Indiana, or a duly authorized employee or corporate officer of the taxpayer.

Yes

No

Is a power of attorney attached?

3. Certified Tax Representatives must attach a Tax Representative Disclosure Statement. 52 IAC 1-2-2.

4. Notify the Indiana Board of Tax Review and the county assessor of any change in your mailing address or telephone number subsequent to filing

this petition.

5. Additional information regarding appeal procedures and hearing practice is available on the IBTR website located at

FAILURE TO FOLLOW INSTRUCTIONS: If the Petitioner does not comply with the instructions for completing this petition, the Indiana Board of Tax

Review may return the form to the Petitioner with a description of the defect. The Petitioner will then have thirty (30) days from the date of notice of defect to

correctly complete the form and resubmit it to the Indiana Board of Tax Review. If the resubmitted form does not comply with the instructions for

completing the form, the Indiana Board of Tax Review may deny the petition. Please complete the checklist provided on page 3 before submitting this petition.

As a result of filing this petition, the assessment may increase, may decrease, or may remain the same.

Check the type of property under appeal (check only one):

Real

Personal

Is this property currently under appeal with the Indiana Board of Tax Review for another tax year?

Yes

No

If yes, indicate year(s) and type of appeal(s): __________________________________________________________________________________________

SECTION I: PROPERTY AND PETITIONER INFORMATION

Parcel or Key number (for real property)

County

Township

Address of property (number and street or rural route)

City

ZIP Code

Legal description provided on Form 11 or Property Record Card (for real property) , or business name (for personal property)

Assessment year under appeal

MARCH 1, ______________

Name of property owner

Telephone Number

E-mail Address

(

)

Address of property owner (number and street or rural route)

City

State

ZIP Code

Name of authorized representative (if different from taxpayer)

Telephone Number

E-mail Address

(

)

Address of authorized representative (number and street or rural route)

City

State

ZIP Code

Form 131, page 1

1

1 2

2 3

3