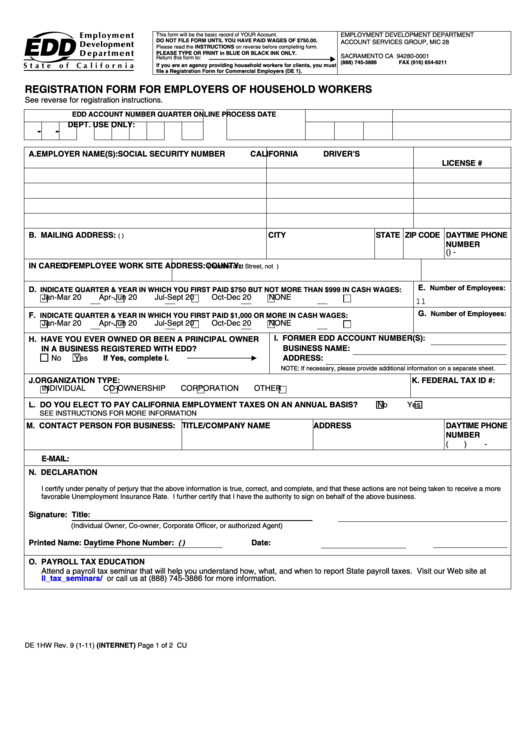

This form will be the basic record of YOUR Account.

EMPLOYMENT DEVELOPMENT DEPARTMENT

DO NOT FILE FORM UNTIL YOU HAVE PAID WAGES OF $750.00.

ACCOUNT SERVICES GROUP, MIC 28

Please read the INSTRUCTIONS on reverse before completing form.

P.O. BOX 826880

PLEASE TYPE OR PRINT in BLUE OR BLACK INK ONLY.

SACRAMENTO CA 94280-0001

Return this form to:

(888) 745-3886

FAX (916) 654-9211

If you are an agency providing household workers for clients, you must

file a Registration Form for Commercial Employers (DE 1).

REGISTRATION FORM FOR EMPLOYERS OF HOUSEHOLD WORKERS

See reverse for registration instructions.

EDD ACCOUNT NUMBER

QUARTER

ONLINE PROCESS DATE

DEPT. USE ONLY:

-

-

A. EMPLOYER NAME(S):

SOCIAL SECURITY NUMBER

CALIFORNIA DRIVER’S

LICENSE #

B. MAILING ADDRESS:

CITY

STATE ZIP CODE DAYTIME PHONE

(P.O. Box / Number and Street)

NUMBER

(

)

-

IN CARE OF:

C. EMPLOYEE WORK SITE ADDRESS:

COUNTY:

(Number and Street, not P.O. Box)

E.

Number of Employees:

D.

INDICATE QUARTER & YEAR IN WHICH YOU FIRST PAID $750 BUT NOT MORE THAN $999 IN CASH WAGES:

Jan-Mar 20

Apr-Jun 20

Jul-Sept 20

Oct-Dec 20

NONE

11

G.

Number of Employees:

F.

INDICATE QUARTER & YEAR IN WHICH YOU FIRST PAID $1,000 OR MORE IN CASH WAGES:

Jan-Mar 20

Apr-Jun 20

Jul-Sept 20

Oct-Dec 20

NONE

H. HAVE YOU EVER OWNED OR BEEN A PRINCIPAL OWNER

I. FORMER EDD ACCOUNT NUMBER(S):

IN A BUSINESS REGISTERED WITH EDD?

BUSINESS NAME:

No

Yes

If Yes, complete I.

ADDRESS:

NOTE: If necessary, please provide additional information on a separate sheet.

J. ORGANIZATION TYPE:

K. FEDERAL TAX ID #:

INDIVIDUAL

CO-OWNERSHIP

CORPORATION

OTHER

L. DO YOU ELECT TO PAY CALIFORNIA EMPLOYMENT TAXES ON AN ANNUAL BASIS?

No

Yes

SEE INSTRUCTIONS FOR MORE INFORMATION

M. CONTACT PERSON FOR BUSINESS: TITLE/COMPANY NAME

ADDRESS

DAYTIME PHONE

NUMBER

(

)

-

E-MAIL:

N. DECLARATION

I certify under penalty of perjury that the above information is true, correct, and complete, and that these actions are not being taken to receive a more

favorable Unemployment Insurance Rate. I further certify that I have the authority to sign on behalf of the above business.

Signature:

Title:

(Individual Owner, Co-owner, Corporate Officer, or authorized Agent)

Printed Name:

Daytime Phone Number:

(

)

Date:

O. PAYROLL TAX EDUCATION

Attend a payroll tax seminar that will help you understand how, what, and when to report State payroll taxes. Visit our Web site at

/payroll_tax_seminars/

or call us at (888) 745-3886 for more information.

DE 1HW Rev. 9 (1-11) (INTERNET)

Page 1 of 2

CU

1

1 2

2