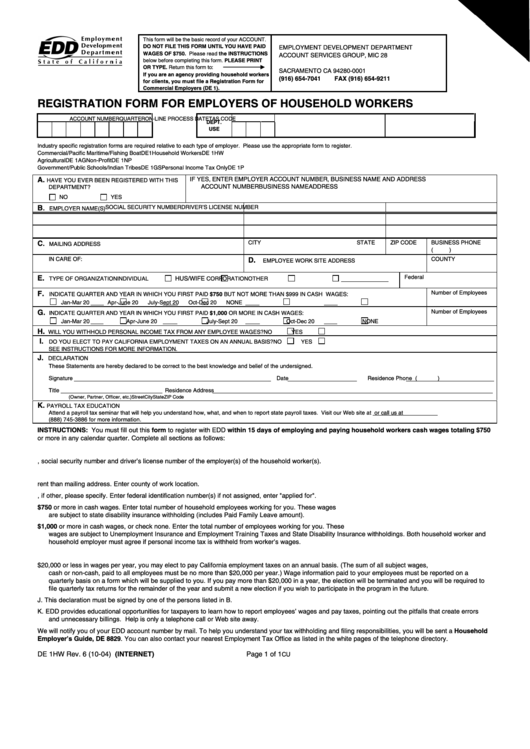

This form will be the basic record of your ACCOUNT.

DO NOT FILE THIS FORM UNTIL YOU HAVE PAID

EMPLOYMENT DEVELOPMENT DEPARTMENT

WAGES OF $750. Please read the INSTRUCTIONS

ACCOUNT SERVICES GROUP, MIC 28

below before completing this form. PLEASE PRINT

P.O. BOX 826880

OR TYPE. Return this form to:

SACRAMENTO CA 94280-0001

If you are an agency providing household workers

(916) 654-7041

FAX (916) 654-9211

for clients, you must file a Registration Form for

Commercial Employers (DE 1).

REGISTRATION FORM FOR EMPLOYERS OF HOUSEHOLD WORKERS

ACCOUNT NUMBER

QUARTER

ON-LINE PROCESS DATE

TAS CODE

DEPT.

USE

Industry specific registration forms are required relative to each type of employer. Please use the appropriate form to register.

Commercial/Pacific Maritime/Fishing Boat

DE1

Household Workers

DE 1HW

Agricultural

DE 1AG

Non-Profit

DE 1NP

Government/Public Schools/Indian Tribes

DE 1GS

Personal Income Tax Only

DE 1P

A.

IF YES, ENTER EMPLOYER ACCOUNT NUMBER, BUSINESS NAME AND ADDRESS

HAVE YOU EVER BEEN REGISTERED WITH THIS

ACCOUNT NUMBER

BUSINESS NAME

ADDRESS

DEPARTMENT?

NO

YES

SOCIAL SECURITY NUMBER

DRIVER’S LICENSE NUMBER

B

.

EMPLOYER NAME(S)

C

CITY

STATE

ZIP CODE

BUSINESS PHONE

.

MAILING ADDRESS

(

)

IN CARE OF:

.

COUNTY

D

EMPLOYEE WORK SITE ADDRESS

Federal I.D. Number

E

.

TYPE OF ORGANIZATION

INDIVIDUAL

HUS/WIFE

CORPORATION

OTHER

Number of Employees

F

.

INDICATE QUARTER AND YEAR IN WHICH YOU FIRST PAID $750 BUT NOT MORE THAN $999 IN CASH WAGES

:

Jan-Mar 20

Apr-June 20

July-Sept 20

Oct-Dec 20

NONE

.

Number of Employees

G

INDICATE QUARTER AND YEAR IN WHICH YOU FIRST PAID $1,000 OR MORE IN CASH WAGES:

Jan-Mar 20

Apr-June 20

July-Sept 20

Oct-Dec 20

NONE

.

H

WILL YOU WITHHOLD PERSONAL INCOME TAX FROM ANY EMPLOYEE WAGES?

NO

YES

I

.

DO YOU ELECT TO PAY CALIFORNIA EMPLOYMENT TAXES ON AN ANNUAL BASIS?

NO

YES

SEE INSTRUCTIONS FOR MORE INFORMATION.

J.

DECLARATION

These Statements are hereby declared to be correct to the best knowledge and belief of the undersigned.

Signature

Date

Residence Phone (

)

Title

Residence Address

(Owner, Partner, Officer, etc.)

Street

City

State

ZIP Code

K.

PAYROLL TAX EDUCATION

Attend a payroll tax seminar that will help you understand how, what, and when to report state payroll taxes. Visit our Web site at /taxsem or call us at

(888) 745-3886 for more information.

INSTRUCTIONS: You must fill out this form to register with EDD within 15 days of employing and paying household workers cash wages totaling $750

or more in any calendar quarter. Complete all sections as follows:

A. Check no or yes box and provide additional information for yes answers.

B. Enter full name, social security number and driver’s license number of the employer(s) of the household worker(s).

C. Enter the address where EDD correspondence and forms should be sent.

D. Enter address where household worker performs duties if different than mailing address. Enter county of work location.

E. Check the appropriate box, if other, please specify. Enter federal identification number(s) if not assigned, enter "applied for".

F. Check the appropriate box when you first paid $750 or more in cash wages. Enter total number of household employees working for you. These wages

are subject to state disability insurance withholding (includes Paid Family Leave amount).

G. Check the appropriate box when you first paid $1,000 or more in cash wages, or check none. Enter the total number of employees working for you. These

wages are subject to Unemployment Insurance and Employment Training Taxes and State Disability Insurance withholdings. Both household worker and

household employer must agree if personal income tax is withheld from worker’s wages.

H. Check the appropriate box.

I.

If you will pay $20,000 or less in wages per year, you may elect to pay California employment taxes on an annual basis. (The sum of all subject wages,

cash or non-cash, paid to all employees must be no more than $20,000 per year.) Wage information paid to your employees must be reported on a

quarterly basis on a form which will be supplied to you. If you pay more than $20,000 in a year, the election will be terminated and you will be required to

file quarterly tax returns for the remainder of the year and submit a new election if you wish to participate in the program in the future.

J. This declaration must be signed by one of the persons listed in B.

K. EDD provides educational opportunities for taxpayers to learn how to report employees’ wages and pay taxes, pointing out the pitfalls that create errors

and unnecessary billings. Help is only a telephone call or Web site away.

We will notify you of your EDD account number by mail. To help you understand your tax withholding and filing responsibilities, you will be sent a Household

Employer’s Guide, DE 8829. You can also contact your nearest Employment Tax Office as listed in the white pages of the telephone directory.

DE 1HW Rev. 6 (10-04) (INTERNET)

Page 1 of 1

CU

1

1