Form De 707f - Annual Payroll Tax Return For Employer Of Household Workers (De 3hw)

ADVERTISEMENT

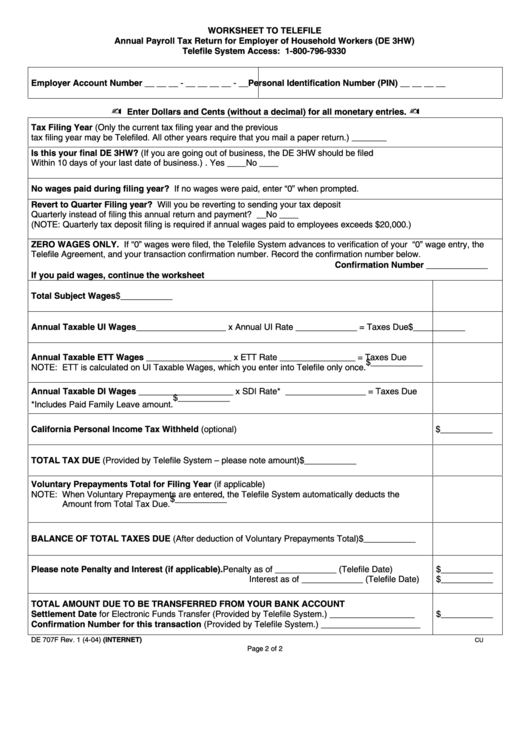

WORKSHEET TO TELEFILE

Annual Payroll Tax Return for Employer of Household Workers (DE 3HW)

Telefile System Access: 1-800-796-9330

Employer Account Number __ __ __ - __ __ __ __ - __

Personal Identification Number (PIN) __ __ __ __

Enter Dollars and Cents (without a decimal) for all monetary entries.

Tax Filing Year (Only the current tax filing year and the previous

tax filing year may be Telefiled. All other years require that you mail a paper return.) ........................................... ________

Is this your final DE 3HW? (If you are going out of business, the DE 3HW should be filed

Within 10 days of your last date of business.) .................................................................................. Yes ____

No ____

No wages paid during filing year? If no wages were paid, enter “0” when prompted.

Revert to Quarter Filing year? Will you be reverting to sending your tax deposit

Quarterly instead of filing this annual return and payment? ............................................................ Yes ____

No ____

(NOTE: Quarterly tax deposit filing is required if annual wages paid to employees exceeds $20,000.)

ZERO WAGES ONLY. If “0” wages were filed, the Telefile System advances to verification of your “0” wage entry, the

Telefile Agreement, and your transaction confirmation number. Record the confirmation number below.

Confirmation Number _____________

If you paid wages, continue the worksheet

$___________

Total Subject Wages

Annual Taxable UI Wages___________________ x Annual UI Rate _____________ = Taxes Due

$___________

Annual Taxable ETT Wages __________________ x ETT Rate ________________ = Taxes Due

$___________

NOTE: ETT is calculated on UI Taxable Wages, which you enter into Telefile only once.

Annual Taxable DI Wages ____________________ x SDI Rate* _________________ = Taxes Due

$___________

*Includes Paid Family Leave amount.

California Personal Income Tax Withheld (optional)

$___________

TOTAL TAX DUE (Provided by Telefile System – please note amount)

$___________

Voluntary Prepayments Total for Filing Year (if applicable)

NOTE: When Voluntary Prepayments are entered, the Telefile System automatically deducts the

$___________

Amount from Total Tax Due.

BALANCE OF TOTAL TAXES DUE (After deduction of Voluntary Prepayments Total)

$___________

Please note Penalty and Interest (if applicable).

Penalty as of _____________ (Telefile Date)

$___________

Interest as of _____________ (Telefile Date)

$___________

TOTAL AMOUNT DUE TO BE TRANSFERRED FROM YOUR BANK ACCOUNT

Settlement Date for Electronic Funds Transfer (Provided by Telefile System.) __________________

$___________

Confirmation Number for this transaction (Provided by Telefile System.) _____________________

DE 707F Rev. 1 (4-04) (INTERNET)

CU

Page 2 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1