Occupational Tax Application - Banks County

ADVERTISEMENT

FOR GOVERNMENT USE ONLY

TAX YEAR

SAVE Affidavit ______

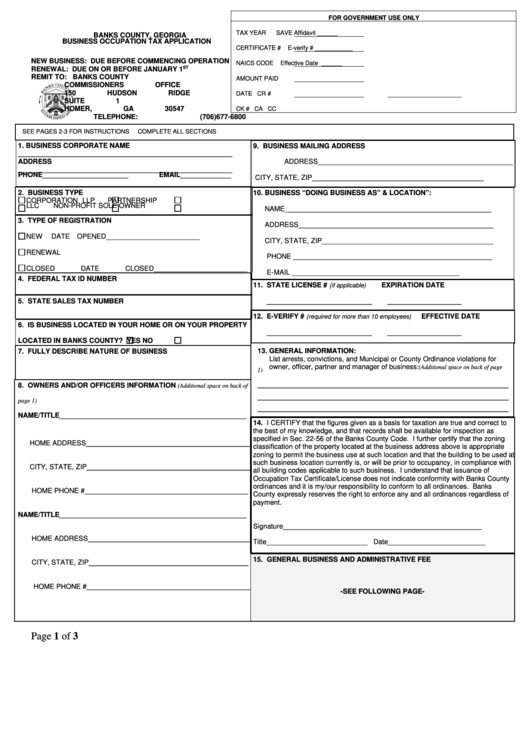

BANKS COUNTY, GEORGIA

BUSINESS OCCUPATION TAX APPLICATION

CERTIFICATE #

E-verify # ___________

NEW BUSINESS: DUE BEFORE COMMENCING OPERATION

NAICS CODE

Effective Date ______

ST

RENEWAL: DUE ON OR BEFORE JANUARY 1

REMIT TO:

BANKS COUNTY

AMOUNT PAID

COMMISSIONERS OFFICE

150 HUDSON RIDGE

DATE

CR #

SUITE 1

HOMER, GA 30547

CK #

CA

CC

TELEPHONE: (706)677-6800

SEE PAGES 2-3 FOR INSTRUCTIONS

COMPLETE ALL SECTIONS

1.

BUSINESS CORPORATE NAME

9. BUSINESS MAILING ADDRESS

_______________________________________________________

ADDRESS

ADDRESS__________________________________________________

_______________________________________________________

PHONE______________________

EMAIL_____________

CITY, STATE, ZIP____________________________________________

2. BUSINESS TYPE

10. BUSINESS “DOING BUSINESS AS” & LOCATION”:

CORPORATION

LLP

PARTNERSHIP

LLC

NON-PROFIT

SOLE OWNER

NAME_____________________________________________________

3. TYPE OF REGISTRATION

ADDRESS__________________________________________________

NEW

DATE OPENED________________________

CITY, STATE, ZIP____________________________________________

RENEWAL

PHONE ___________________________________________________

CLOSED

DATE CLOSED________________________

E-MAIL ___________________________________________

4. FEDERAL TAX ID NUMBER

11. STATE LICENSE #

EXPIRATION DATE

(if applicable)

5. STATE SALES TAX NUMBER

___________________________

___________________

12. E-VERIFY #

EFFECTIVE DATE

(required for more than 10 employees)

6. IS BUSINESS LOCATED IN YOUR HOME OR ON YOUR PROPERTY

___________________________

___________________

LOCATED IN BANKS COUNTY?

YES

NO

13. GENERAL INFORMATION:

7. FULLY DESCRIBE NATURE OF BUSINESS

List arrests, convictions, and Municipal or County Ordinance violations for

owner, officer, partner and manager of business:

(Additional space on back of page

1)

________________________________________________

8. OWNERS AND/OR OFFICERS INFORMATION

(Additional space on back of

________________________________________________

page 1)

________________________________________________

NAME/TITLE________________________________________________

14. I CERTIFY that the figures given as a basis for taxation are true and correct to

the best of my knowledge, and that records shall be available for inspection as

specified in Sec. 22-56 of the Banks County Code. I further certify that the zoning

HOME ADDRESS__________________________________________

classification of the property located at the business address above is appropriate

zoning to permit the business use at such location and that the building to be used at

such business location currently is, or will be prior to occupancy, in compliance with

CITY, STATE, ZIP__________________________________________

all building codes applicable to such business. I understand that issuance of

Occupation Tax Certificate/License does not indicate conformity with Banks County

ordinances and it is my/our responsibility to conform to all ordinances. Banks

HOME PHONE #__________________________________________

County expressly reserves the right to enforce any and all ordinances regardless of

payment.

NAME/TITLE________________________________________________

Signature___________________________________________________

HOME ADDRESS__________________________________________

Title__________________________

Date_________________________

15. GENERAL BUSINESS AND ADMINISTRATIVE FEE

CITY, STATE, ZIP_________________________________________

HOME PHONE #__________________________________________

-SEE FOLLOWING PAGE-

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3