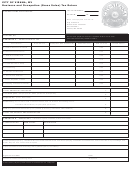

2015 Personal Property Tax Return Form - City Of Waterville Page 2

ADVERTISEMENT

Instructions:

Print or type all information.

Column 1. Enter a brief description of items being

reported. Ex. 21 cubic foot freezer

Page 3, Owner Information Section

Column 2. Enter the quantity or number of items

being reported in Column 1.

Line 1. Enter the name or names of all legal

Column 3. Enter the year of manufacture

owners.

Column 4. Enter the year of acquisition/placed in

service.

Line 2. Enter the name of the business.

Column 5. Enter a checkmark in the box if

Line 2a If you have changed the name of your

equipment was acquired NEW.

business, enter the previous or old name.

Column 6. Enter a checkmark in the box if the

equipment was acquired USED.

Line 3. Indicate the correct business structure of the

Column 7. If used, enter the place name of where

enterprise. Ex. Ann B. Coe and Dana E. Former

the item was previously located.

operate a limited partnership, and are doing

Column 8. Enter the original cost of the item.

business as Coe & Former Consulting.

Column 9. Enter related costs, such as installation,

special piping, foundations, wiring, shipping and

Line 4. Enter the official mailing address of the

handling, etc..

business activity.

Column 10. Enter location of the equipment.

Ex. 100 Main St

Line 5. Enter the location of the business activity.

Column 11. Enter a checkmark if the State of Maine

Business Equipment Tax Reimbursement (BETR)

Line 6a. Enter the legal name of the corporation

will be requested for the upcoming tax year.

Line 6b. Enter names of corporate official(s) or

Column 12. MAKE NO ENTRY - OFFICE USE

representative(s) and their title(s).

Line 6c. Enter the corporate address.

No Changes - If you have not acquired or removed

Line 6d. Enter the State of Incorporation.

ANY property, then check the No Changes box.

Line 7. Enter account number on the mailing label.

Page 4, Leased Equipment

Enter a checkmark if a NEW ACCOUNT.

Column 1. Enter the name of the Lessor and their

Line 8. Enter a checkmark in the box beside the

address

business type that best describes the business

Column 2. Enter the telephone number, including

activity.

area code, of the lessor.

Column 3. Enter a brief description of the leased

Line 9. Enter Preparer’s name, address and

item.

telephone number, if other than the owner.

Column 4. Enter the lease fee paid.

Column 5. Enter the term of the lease. Ex. 5 years

Line 10. Enter correct address for billing and all

or 36 months

related mailings. If address differs from mailing

Column 6. Enter information about any purchase

label, enter a checkmark in the corresponding box.

option that is a part of the lease.

Line 11. Enter date business activity ended.

Attach additional pages as necessary.

Declare any equipment transferred, the date, to

whom it was transferred and their address.

Line 12. Sign and date the Personal Property Tax

Return form and return to the address indicated, by

the filing date.

Page 4, Declaration of Personal Property

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4