County Of Nassau Real Estate Transfer Tax Return

ADVERTISEMENT

Recording Office Time Stamp

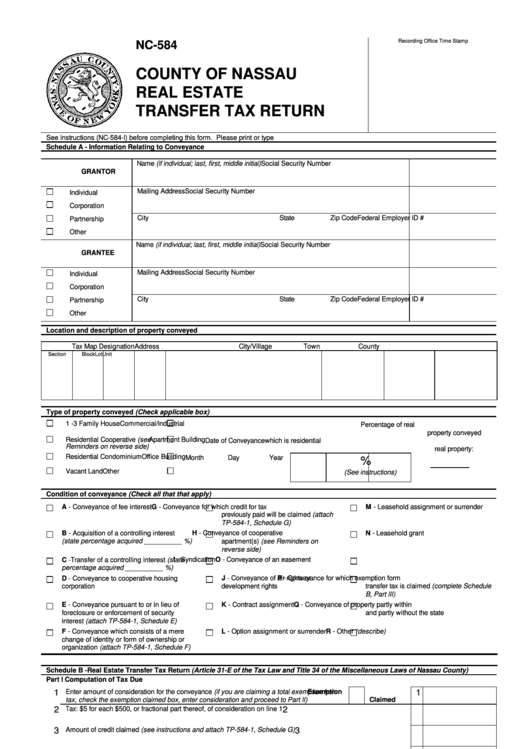

NC-584

COUNTY OF NASSAU

REAL ESTATE

TRANSFER TAX RETURN

See Instructions (NC-584-I) before completing this form. Please print or type

Schedule A - Information Relating to Conveyance

Name (if individual; last, first, middle initial)

Social Security Number

GRANTOR

Mailing Address

Social Security Number

Individual

Corporation

City

State

Zip Code

Federal Employer ID #

Partnership

Other

Name (if individual; last, first, middle initial)

Social Security Number

GRANTEE

Mailing Address

Social Security Number

Individual

Corporation

City

State

Zip Code

Federal Employer ID #

Partnership

Other

Location and description of property conveyed

Tax Map Designation

Address

City/Village

Town

County

Section

Block

Lot

Unit

Type of property conveyed (Check applicable box)

1 -3 Family House

Commercial/Industrial

Percentage of real

property conveyed

Residential Cooperative (see

Apartment Building

Date of Conveyance

which is residential

Reminders on reverse side)

real property:

Residential Condominium

Office Building

Month

Day

Year

%

Vacant Land

Other

(See instructions)

Condition of conveyance (Check all that that apply)

A - Conveyance of fee interest

G - Conveyance for which credit for tax

M - Leasehold assignment or surrender

previously paid will be claimed (attach

TP-584-1, Schedule G)

B - Acquisition of a controlling interest

H - Conveyance of cooperative

N - Leasehold grant

(state percentage acquired __________ %)

apartment(s) (see Reminders on

reverse side)

C -Transfer of a controlling interest (state

I - Syndication

O - Conveyance of an easement

percentage acquired __________ %)

D - Conveyance to cooperative housing

J - Conveyance of air rights or

P - Conveyance for which exemption form

corporation

development rights

transfer tax is claimed (complete Schedule

B, Part III)

E - Conveyance pursuant to or in lieu of

K - Contract assignment

Q - Conveyance of property partly within

foreclosure or enforcement of security

and partly without the state

interest (attach TP-584-1, Schedule E)

F - Conveyance which consists of a mere

L - Option assignment or surrender

R - Other (describe)

change of identity or form of ownership or

organization (attach TP-584-1, Schedule F)

Schedule B -Real Estate Transfer Tax Return (Article 31-E of the Tax Law and Title 34 of the Miscellaneous Laws of Nassau County)

Part I Computation of Tax Due

1

Enter amount of consideration for the conveyance (if you are claiming a total exemption from

Exemption

1

tax, check the exemption claimed box, enter consideration and proceed to Part II)

Claimed

Tax: $5 for each $500, or fractional part thereof, of consideration on line 1

2

2

3

Amount of credit claimed (see instructions and attach TP-584-1, Schedule G)

3

4

Total Tax due (subtract line 3 from line 2)

4

Please make checks payable to: Nassau County Clerk

For Recording Officer’ s Use

Amount Received

Date Received

Transaction Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2