P005 125 - Fsa Claim Form

Download a blank fillable P005 125 - Fsa Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete P005 125 - Fsa Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

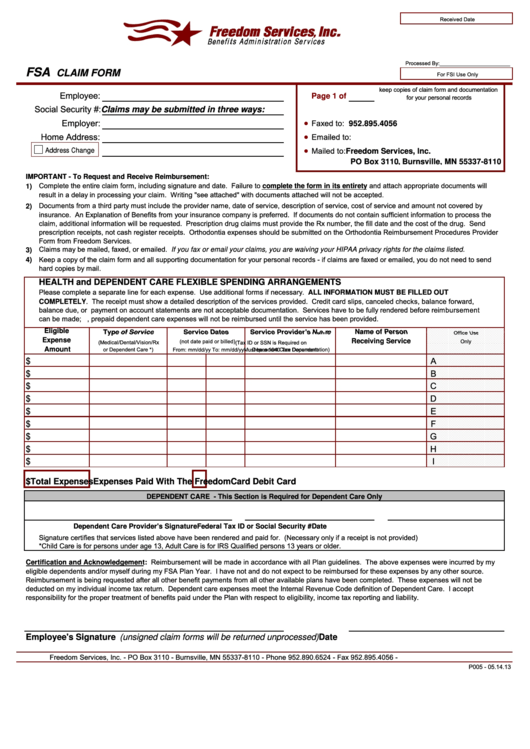

Received Date

Processed By:________________________

FSA

CLAIM FORM

For FSI Use Only

keep copies of claim form and documentation

Employee:

Page 1 of

for your personal records

Social Security #:

Claims may be submitted in three ways:

Employer:

●

Faxed to: 952.895.4056

Home Address:

●

Emailed to:

Address Change

●

Mailed to: Freedom Services, Inc.

PO Box 3110, Burnsville, MN 55337-8110

IMPORTANT - To Request and Receive Reimbursement:

Complete the entire claim form, including signature and date. Failure to complete the form in its entirety and attach appropriate documents will

1)

result in a delay in processing your claim. Writing "see attached" with documents attached will not be accepted.

Documents from a third party must include the provider name, date of service, description of service, cost of service and amount not covered by

2)

insurance. An Explanation of Benefits from your insurance company is preferred. If documents do not contain sufficient information to process the

claim, additional information will be requested. Prescription drug claims must provide the Rx number, the fill date and the cost of the drug. Send

prescription receipts, not cash register receipts. Orthodontia expenses should be submitted on the Orthodontia Reimbursement Procedures Provider

Form from Freedom Services.

Claims may be mailed, faxed, or emailed. If you fax or email your claims, you are waiving your HIPAA privacy rights for the claims listed.

3)

Keep a copy of the claim form and all supporting documentation for your personal records - if claims are faxed or emailed, you do not need to send

4)

hard copies by mail.

HEALTH and DEPENDENT CARE FLEXIBLE SPENDING ARRANGEMENTS

Please complete a separate line for each expense. Use additional forms if necessary. ALL INFORMATION MUST BE FILLED OUT

COMPLETELY. The receipt must show a detailed description of the services provided. Credit card slips, canceled checks, balance forward,

balance due, or payment on account statements are not acceptable documentation. Services have to be fully rendered before reimbursement

can be made; i.e., prepaid dependent care expenses will not be reimbursed until the service has been provided.

Eligible

Eligible

Name of Person

Name of Person

Type of Service

Type of Service

Service Dates

Service Dates

Service Provider's Name

Service Provider s Name

Office Use

Office Use

Expense

Receiving Service

(not date paid or billed)

Only

(Medical/Dental/Vision/Rx

(Tax ID or SSN is Required on

Amount

or Dependent Care *)

From: mm/dd/yy To: mm/dd/yy

Dependent Care Documentation)

Must be a 1040 Tax Dependent

$

A

$

B

$

C

$

D

$

E

$

F

$

G

$

H

$

I

$

Total Expenses

Expenses Paid With The FreedomCard Debit Card

DEPENDENT CARE - This Section is Required for Dependent Care Only

Dependent Care Provider's Signature

Federal Tax ID or Social Security #

Date

Signature certifies that services listed above have been rendered and paid for. (Necessary only if a receipt is not provided)

*Child Care is for persons under age 13, Adult Care is for IRS Qualified persons 13 years or older.

Certification and Acknowledgement: Reimbursement will be made in accordance with all Plan guidelines. The above expenses were incurred by my

eligible dependents and/or myself during my FSA Plan Year. I have not and do not expect to be reimbursed for these expenses by any other source.

Reimbursement is being requested after all other benefit payments from all other available plans have been completed. These expenses will not be

deducted on my individual income tax return. Dependent care expenses meet the Internal Revenue Code definition of Dependent Care. I accept

responsibility for the proper treatment of benefits paid under the Plan with respect to eligibility, income tax reporting and liability.

Employee's Signature (unsigned claim forms will be returned unprocessed)

Date

Freedom Services, Inc. - PO Box 3110 - Burnsville, MN 55337-8110 - Phone 952.890.6524 - Fax 952.895.4056 -

P005 - 05.14.13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1