INSTRUCTIONS – SUPPLEMENTAL SOLICITATION REPORT (CHARITABLE ORGANIZATION)

General Instructions: Please access this form online, enter the requested information in the fields provided, print the

completed form and mail it to the Charities Program. Complete the entire form or type “N/A” if not applicable and check

boxes where indicated. Incomplete forms will not be accepted. Do not staple or bind form or its attachments (e.g. IRS

federal return). Please clearly label all attachments with the Section number to which they correspond. Unless otherwise

specified, all questions should be answered in the present tense, with current information.

Do not submit the Supplemental Solicitation Report form in lieu of a registration form.

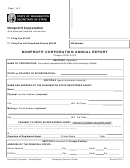

Page 1: Check the Supplemental Report box and enter the organization’s registration number on the line provided. Your

registration number can be obtained by conducting an online search at

Check the Expedited Service box to request priority processing within two working days of submission or as soon

thereafter as possible; a $50 fee applies.

Section 1: Enter the full, legal name of the organization on the line provided.

Section 2: Enter the full effective date of the organization’s change in accounting year. Provide the full begin & end dates

of the organization’s previous and new accounting years on the lines provided. Additional comments, if any, may be

entered on the line provided.

Section 3A: The questions in this section pertain to the “transition” (or short) accounting period following the

organization’s change in accounting year.

Check the appropriate boxes indicating if the organization filed a federal informational return with the IRS for the

accounting period reported and, if so, what type of federal return was filed. If a federal return has not been filed, check the

appropriate box indicating the reason.

REQUIRED ENCLOSURE: If the organization is required to file a federal informational return with the IRS for the

accounting period reported, a complete photocopy of the federal return (e.g. Form 990, 990-EZ or 990-PF) must be

submitted with this form. A copy of the Form 990-N (e-Postcard) is not required. Include all applicable Schedules and

attachments required by the IRS, except Schedule B / contributors list. Do not include social security numbers or other

personal identifiers, bank account information or statements, or the organization’s annual report with this form.

IMPORTANT NOTE: If a federal return is required, but has not yet been submitted to the IRS, please contact the

Charities Program for additional instructions prior to submitting this form. If the organization is not required to file a federal

return with the IRS for the accounting period reported, it will not be necessary to submit one to satisfy WA state reporting

requirements.

Section 3B – SOLICITATION REPORT: Enter the full begin and end dates of the accounting period on the lines provided

(partial dates will not be accepted). Complete lines 1 through 8, regardless of whether or not a federal return was

filed with the IRS. Actual, gross figures are required; net figures or estimates will not be accepted. Do not leave any lines

blank – enter zero if the organization does not have any financial information to report for a specific line item.

GUIDELINES AVAILABLE: If the organization filed an IRS Form 990, 990EZ or 990PF for the accounting period

reported, suggested guidelines for completing the Solicitation Report using line items from the federal return can be

obtained at

or by contacting the Charities

Program directly.

1. Enter the gross dollar value of contributions received from solicitations. “Solicitations” include, but are not limited to,

special events, sales of inventory, and amounts collected on behalf of the charitable organization by a commercial

fundraiser or commercial coventurer;

2. Enter the gross dollar value of revenue from all other sources (not the result of a solicitation);

3. Enter the total dollar value of gross receipts. (Line 3 is the sum of lines 1 and 2) “Gross receipts” include, but are not

limited to, contributions, gross revenue from special events, sales of inventory, goods or services (including tickets to

events), all other revenue from solicitations, and amounts collected on behalf of the charitable organization by a

commercial fundraiser or commercial coventurer, regardless of custody of funds;

4. Enter the gross dollar value of expenditures used directly for charitable program services. Payments to affiliates may be

included if costs involved are not connected with the administrative or fundraising functions of the reporting organization;

5. Enter the gross dollar value of expenditures used for administrative and fundraising, including amounts paid to or

Charitable Organization Supplemental

Washington Secretary of State

Revised 11/2010

1

1 2

2 3

3 4

4