Clear Form

Print Form

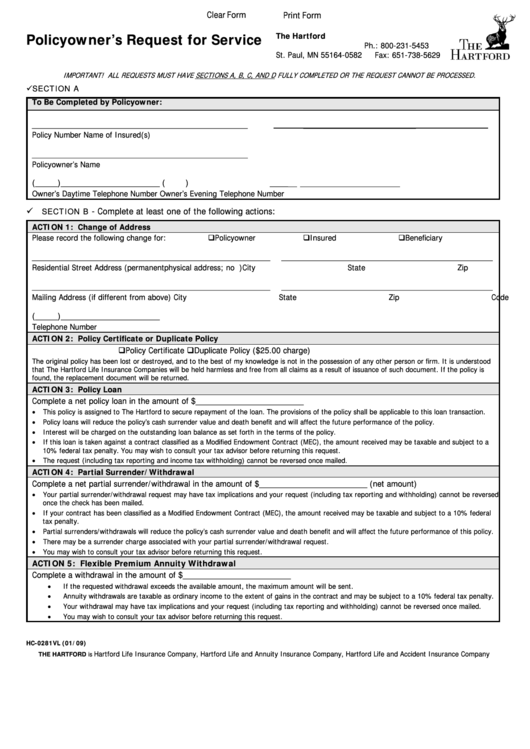

Policyowner’s Request for Service

The Hartford

P.O. Box 64582

Ph.: 800-231-5453

St. Paul, MN 55164-0582

Fax: 651-738-5629

IMPORTANT! ALL REQUESTS MUST HAVE SECTIONS A, B, C, AND D FULLY COMPLETED OR THE REQUEST CANNOT BE PROCESSED.

SECTION A

To Be Completed by Policyowner:

________________________________________________

_________________________

Policy Number

Name of Insured(s)

________________________________________________

Policyowner’s Name

(_____)______________________

(

)

____

Owner’s Daytime Telephone Number

Owner’s Evening Telephone Number

SECTION B

- Complete at least one of the following actions:

ACTION 1: Change of Address

Please record the following change for:

Policyowner

Insured

Beneficiary

_____________________________________________________

_______________________________________________

Residential Street Address (permanent physical address; no P.O. Box)

City

State

Zip Code

_____________________________________________________

_______________________________________________

Mailing Address (if different from above)

City

State

Zip Code

(_____)______________________

Telephone Number

ACTION 2: Policy Certificate or Duplicate Policy

Policy Certificate

Duplicate Policy ($25.00 charge)

The original policy has been lost or destroyed, and to the best of my knowledge is not in the possession of any other person or firm. It is understood

that The Hartford Life Insurance Companies will be held harmless and free from all claims as a result of issuance of such document. If the policy is

found, the replacement document will be returned.

ACTION 3: Policy Loan

Complete a net policy loan in the amount of $________________________

•

This policy is assigned to The Hartford to secure repayment of the loan. The provisions of the policy shall be applicable to this loan transaction.

•

Policy loans will reduce the policy’s cash surrender value and death benefit and will affect the future performance of the policy.

•

Interest will be charged on the outstanding loan balance as set forth in the terms of the policy.

•

If this loan is taken against a contract classified as a Modified Endowment Contract (MEC), the amount received may be taxable and subject to a

10% federal tax penalty. You may wish to consult your tax advisor before returning this request.

•

The request (including tax reporting and income tax withholding) cannot be reversed once mailed.

ACTION 4: Partial Surrender/Withdrawal

Complete a net partial surrender/withdrawal in the amount of $________________________ (net amount)

•

Your partial surrender/withdrawal request may have tax implications and your request (including tax reporting and withholding) cannot be reversed

once the check has been mailed.

•

If your contract has been classified as a Modified Endowment Contract (MEC), the amount received may be taxable and subject to a 10% federal

tax penalty.

•

Partial surrenders/withdrawals will reduce the policy’s cash surrender value and death benefit and will affect the future performance of this policy.

•

There may be a surrender charge associated with your partial surrender/withdrawal request.

•

You may wish to consult your tax advisor before returning this request.

ACTION 5: Flexible Premium Annuity Withdrawal

Complete a withdrawal in the amount of $________________________

•

If the requested withdrawal exceeds the available amount, the maximum amount will be sent.

•

Annuity withdrawals are taxable as ordinary income to the extent of gains in the contract and may be subject to a 10% federal tax penalty.

•

Your withdrawal may have tax implications and your request (including tax reporting and withholding) cannot be reversed once mailed.

•

You may wish to consult your tax advisor before returning this request.

HC-0281VL (01/09)

Hartford Life Insurance Company, Hartford Life and Annuity Insurance Company, Hartford Life and Accident Insurance Company

THE HARTFORD is

1

1 2

2