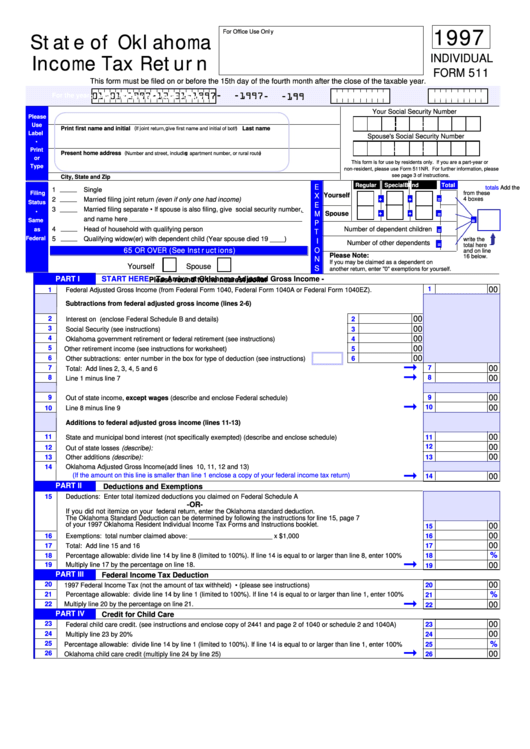

State Of Oklahoma Income Tax Return

ADVERTISEMENT

For Office Use Only

1997

State of Oklahoma

INDIVIDUAL

Income Tax Return

FORM 511

This form must be filed on or before the 15th day of the fourth month after the close of the taxable year.

For the year

01-01-1997-12-31-1997

or other taxable year beginning

-

-1997

-

-199

ending

Your Social Security Number

Please

Use

Print first name and initial

Last name

(If joint return, give first name and initial of both)

Label

Spouse's Social Security Number

•

Print

Present home address

(Number and street, including apartment number, or rural route)

or

This form is for use by residents only. If you are a part-year or

Type

non-resident, please use Form 511NR. For further information, please

see page 3 of instructions.

City, State and Zip

Regular

Special

Blind

Total

E

Add the

totals

1

Single

Filing

from these

Yourself

X

2

Married filing joint return (even if only one had income)

+

+

=

4 boxes

Status

E

3

Married filing separate • If spouse is also filing, give social security number,

•

Spouse

+

+

=

M

and name here

Same

=

P

4

Head of household with qualifying person

Number of dependent children

as

=

T

Federal

5

Qualifying widow(er) with dependent child (Year spouse died 19 ____)

write the

I

Number of other dependents

=

total here

65 OR OVER (See Instructions)

O

and on line

Please Note:

16 below.

N

If you may be claimed as a dependent on

Yourself

Spouse

S

another return, enter "0" exemptions for yourself.

PART I

START HERE

- To Arrive at Oklahoma Adjusted Gross Income -

Please round to the nearest dollar

......................

00

1

1

Federal Adjusted Gross Income (from Federal Form 1040, Federal Form 1040A or Federal Form 1040EZ).

Subtractions from federal adjusted gross income (lines 2-6)

2

00

..................

Interest on U.S. Government obligations (enclose Federal Schedule B and details)

2

00

3

.......................................................................................

Social Security (see instructions)

3

00

4

................................

Oklahoma government retirement or federal retirement (see instructions)

4

00

5

.......................................................

Other retirement income (see instructions for worksheet)

5

6

00

Other subtractions: enter number in the box for type of deduction (see instructions)

6

7

7

00

.....................................................................................................................

Total: Add lines 2, 3, 4, 5 and 6

00

8

.........................................................................................................................................

8

Line 1 minus line 7

00

9

9

............................................................

Out of state income, except wages (describe and enclose Federal schedule)

10

00

.......................................................................................................................................

10

Line 8 minus line 9

Additions to federal adjusted gross income (lines 11-13)

00

11

.......................................

State and municipal bond interest (not specifically exempted) (describe and enclose schedule)

11

00

12

.................................................................................................................................

12

Out of state losses (describe):

.......................................................................................................................................

00

13

Other additions (describe):

13

14

Oklahoma Adjusted Gross Income (add lines 10, 11, 12 and 13)

(If the amount on this line is smaller than line 1 enclose a copy of your federal income tax return)

........................

00

14

PART II

Deductions and Exemptions

15

Deductions: Enter total itemized deductions you claimed on Federal Schedule A

-OR-

If you did not itemize on your federal return, enter the Oklahoma standard deduction.

The Oklahoma Standard Deduction can be determined by following the instructions for line 15, page 7

of your 1997 Oklahoma Resident Individual Income Tax Forms and Instructions booklet.

...............................................

00

15

........................................................

00

16

Exemptions: total number claimed above: _______________________ x $1,000

16

.......................................................................................................................................

00

17

Total: Add line 15 and 16

17

.......

%

18

Percentage allowable: divide line 14 by line 8 (limited to 100%). If line 14 is equal to or larger than line 8, enter 100%

18

....................................................................................................

00

19

Multiply line 17 by the percentage on line 18.

19

PART III

Federal Income Tax Deduction

...................................................

20

00

1997 Federal Income Tax (not the amount of tax withheld) • (please see instructions)

20

.......

%

21

Percentage allowable: divide line 14 by line 1 (limited to 100%). If line 14 is equal to or larger than line 1, enter 100%

21

.....................................................................................................

00

22

Multiply line 20 by the percentage on line 21.

22

PART IV

Credit for Child Care

00

23

.........

Federal child care credit. (see instructions and enclose copy of 2441 and page 2 of 1040 or schedule 2 and 1040A)

23

24

00

.........................................................................................................................................

Multiply line 23 by 20%

24

%

25

.......

Percentage allowable: divide line 14 by line 1 (limited to 100%). If line 14 is equal to or larger than line 1, enter 100%

25

00

26

.....................................................................................

Oklahoma child care credit (multiply line 24 by line 25)

26

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2