2015-16 Institutional Verification Supplement For Tax Extension Filer (Fafsa)

ADVERTISEMENT

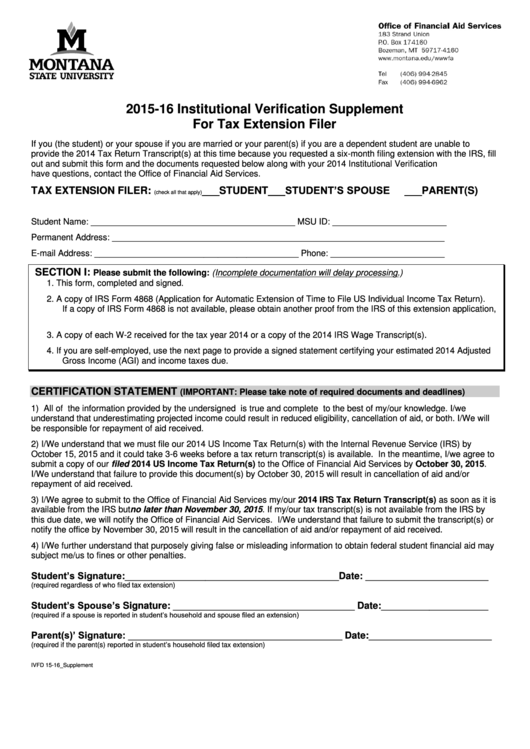

2015-16 Institutional Verification Supplement

For Tax Extension Filer

If you (the student) or your spouse if you are married or your parent(s) if you are a dependent student are unable to

provide the 2014 Tax Return Transcript(s) at this time because you requested a six-month filing extension with the IRS, fill

out and submit this form and the documents requested below along with your 2014 Institutional Verification Form. If you

have questions, contact the Office of Financial Aid Services.

___STUDENT’S SPOUSE

TAX EXTENSION FILER:

___STUDENT

___PARENT(S)

(check all that apply)

Student Name: ___________________________________________ MSU ID: ________________________

Permanent Address: ______________________________________________________________________

E-mail Address: ___________________________________________ Phone: ________________________

SECTION I:

Please submit the following: (Incomplete documentation will delay processing.)

1. This form, completed and signed.

2. A copy of IRS Form 4868 (Application for Automatic Extension of Time to File US Individual Income Tax Return).

If a copy of IRS Form 4868 is not available, please obtain another proof from the IRS of this extension application,

e.g. the 2014 Tax Account Transcript will show that the IRS has received your Form 4868.

3. A copy of each W-2 received for the tax year 2014 or a copy of the 2014 IRS Wage Transcript(s).

4. If you are self-employed, use the next page to provide a signed statement certifying your estimated 2014 Adjusted

Gross Income (AGI) and income taxes due.

CERTIFICATION STATEMENT

(IMPORTANT: Please take note of required documents and deadlines)

1) All of the information provided by the undersigned is true and complete to the best of my/our knowledge. I/we

understand that underestimating projected income could result in reduced eligibility, cancellation of aid, or both. I/We will

be responsible for repayment of aid received.

2) I/We understand that we must file our 2014 US Income Tax Return(s) with the Internal Revenue Service (IRS) by

October 15, 2015 and it could take 3-6 weeks before a tax return transcript(s) is available. In the meantime, I/we agree to

submit a copy of our filed 2014 US Income Tax Return(s) to the Office of Financial Aid Services by October 30, 2015.

I/We understand that failure to provide this document(s) by October 30, 2015 will result in cancellation of aid and/or

repayment of aid received.

3) I/We agree to submit to the Office of Financial Aid Services my/our 2014 IRS Tax Return Transcript(s) as soon as it is

available from the IRS but no later than November 30, 2015. If my/our tax transcript(s) is not available from the IRS by

this due date, we will notify the Office of Financial Aid Services. I/We understand that failure to submit the transcript(s) or

notify the office by November 30, 2015 will result in the cancellation of aid and/or repayment of aid received.

4) I/We further understand that purposely giving false or misleading information to obtain federal student financial aid may

subject me/us to fines or other penalties.

Student’s Signature: ________________________________________ Date: _______________________

(required regardless of who filed tax extension)

Student’s Spouse’s Signature: __________________________________ Date: ____________________

(required if a spouse is reported in student’s household and spouse filed an extension)

Parent(s)’ Signature: ________________________________________ Date: _______________________

(required if the parent(s) reported in student’s household filed tax extension)

IVFD 15-16_Supplement

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2