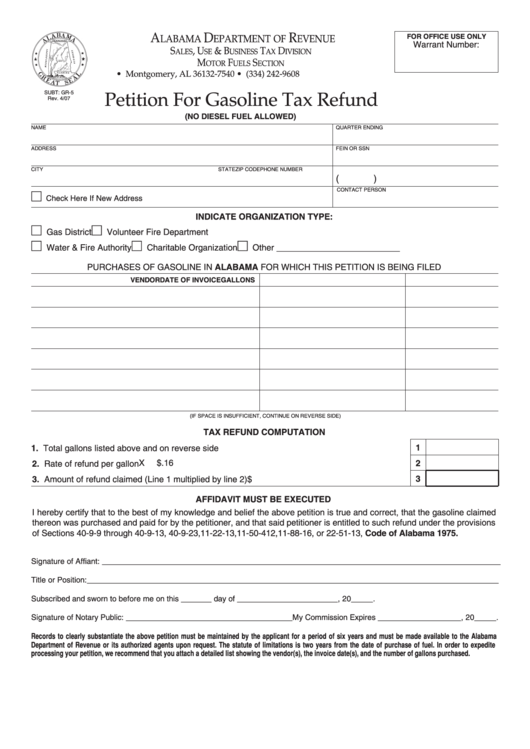

Petition For Gasoline Tax Refund

Download a blank fillable Petition For Gasoline Tax Refund in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Petition For Gasoline Tax Refund with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset

A

D

R

LABAMA

EPARTMENT OF

EVENUE

FOR OFFICE USE ONLY

Warrant Number:

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

M

F

S

OTOR

UELS

ECTION

P.O. Box 327540 • Montgomery, AL 36132-7540 • (334) 242-9608

SUBT: GR-5

Petition For Gasoline Tax Refund

Rev. 4/07

(NO DIESEL FUEL ALLOWED)

NAME

QUARTER ENDING

ADDRESS

FEIN OR SSN

CITY

STATE

ZIP CODE

PHONE NUMBER

(

)

CONTACT PERSON

Check Here If New Address

INDICATE ORGANIZATION TYPE:

Gas District

Volunteer Fire Department

Water & Fire Authority

Charitable Organization

Other __________________________

PURCHASES OF GASOLINE IN ALABAMA FOR WHICH THIS PETITION IS BEING FILED

VENDOR

DATE OF INVOICE

GALLONS

(IF SPACE IS INSUFFICIENT, CONTINUE ON REVERSE SIDE)

TAX REFUND COMPUTATION

1

1. Total gallons listed above and on reverse side . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

X

$.16

2

2. Rate of refund per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Amount of refund claimed (Line 1 multiplied by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

AFFIDAVIT MUST BE EXECUTED

I hereby certify that to the best of my knowledge and belief the above petition is true and correct, that the gasoline claimed

thereon was purchased and paid for by the petitioner, and that said petitioner is entitled to such refund under the provisions

of Sections 40-9-9 through 40-9-13, 40-9-23, 11-22-13, 11-50-412, 11-88-16, or 22-51-13, Code of Alabama 1975.

Signature of Affiant: ___________________________________________________________________________________________

Title or Position: ______________________________________________________________________________________________

Subscribed and sworn to before me on this _______ day of _______________________, 20_____.

Signature of Notary Public: ______________________________________ My Commission Expires ___________________, 20_____.

Records to clearly substantiate the above petition must be maintained by the applicant for a period of six years and must be made available to the Alabama

Department of Revenue or its authorized agents upon request. The statute of limitations is two years from the date of purchase of fuel. In order to expedite

processing your petition, we recommend that you attach a detailed list showing the vendor(s), the invoice date(s), and the number of gallons purchased.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2