Instructions For Sales Tax Refunds

ADVERTISEMENT

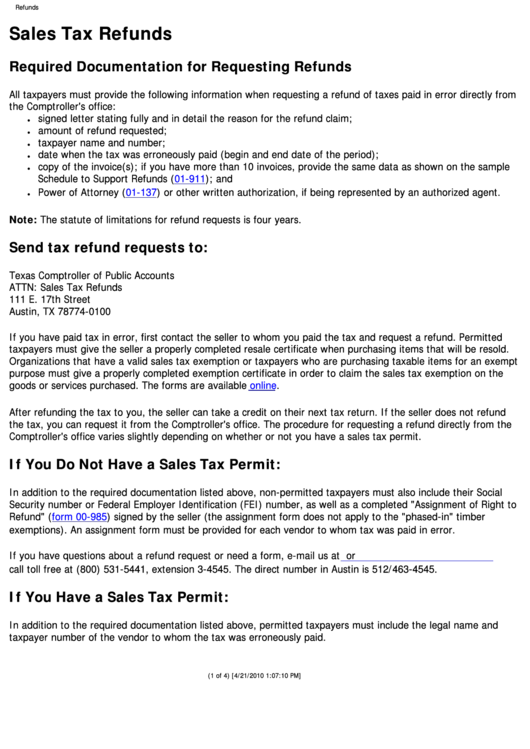

Refunds

Sales Tax Refunds

Required Documentation for Requesting Refunds

All taxpayers must provide the following information when requesting a refund of taxes paid in error directly from

the Comptroller's office:

signed letter stating fully and in detail the reason for the refund claim;

●

amount of refund requested;

●

taxpayer name and number;

●

date when the tax was erroneously paid (begin and end date of the period);

●

copy of the invoice(s); if you have more than 10 invoices, provide the same data as shown on the sample

●

Schedule to Support Refunds (01-911); and

Power of Attorney (01-137) or other written authorization, if being represented by an authorized agent.

●

Note: The statute of limitations for refund requests is four years.

Send tax refund requests to:

Texas Comptroller of Public Accounts

ATTN: Sales Tax Refunds

111 E. 17th Street

Austin, TX 78774-0100

If you have paid tax in error, first contact the seller to whom you paid the tax and request a refund. Permitted

taxpayers must give the seller a properly completed resale certificate when purchasing items that will be resold.

Organizations that have a valid sales tax exemption or taxpayers who are purchasing taxable items for an exempt

purpose must give a properly completed exemption certificate in order to claim the sales tax exemption on the

goods or services purchased. The forms are available online.

After refunding the tax to you, the seller can take a credit on their next tax return. If the seller does not refund

the tax, you can request it from the Comptroller's office. The procedure for requesting a refund directly from the

Comptroller's office varies slightly depending on whether or not you have a sales tax permit.

If You Do Not Have a Sales Tax Permit:

In addition to the required documentation listed above, non-permitted taxpayers must also include their Social

Security number or Federal Employer Identification (FEI) number, as well as a completed "Assignment of Right to

Refund"

(form

00-985) signed by the seller (the assignment form does not apply to the "phased-in" timber

exemptions). An assignment form must be provided for each vendor to whom tax was paid in error.

If you have questions about a refund request or need a form, e-mail us at

refundreq.revacct@cpa.state.tx.us

or

call toll free at (800) 531-5441, extension 3-4545. The direct number in Austin is 512/463-4545.

If You Have a Sales Tax Permit:

In addition to the required documentation listed above, permitted taxpayers must include the legal name and

taxpayer number of the vendor to whom the tax was erroneously paid.

(1 of 4) [4/21/2010 1:07:10 PM]

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4