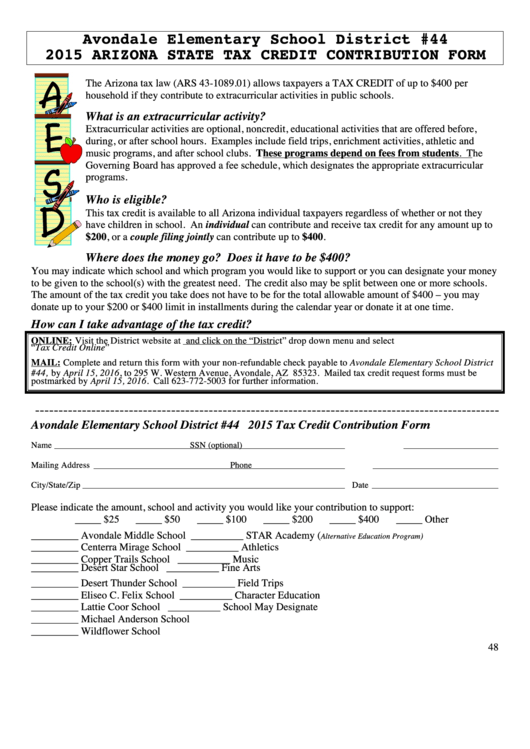

2015 Arizona State Tax Credit Contribution Form

ADVERTISEMENT

Avondale Elementary School District #44

2015 ARIZONA STATE TAX CREDIT CONTRIBUTION FORM

The Arizona tax law (ARS 43-1089.01) allows taxpayers a TAX CREDIT of up to $400 per

household if they contribute to extracurricular activities in public schools.

What is an extracurricular activity?

Extracurricular activities are optional, noncredit, educational activities that are offered before,

during, or after school hours. Examples include field trips, enrichment activities, athletic and

music programs, and after school clubs. These programs depend on fees from students. The

Governing Board has approved a fee schedule, which designates the appropriate extracurricular

programs.

Who is eligible?

This tax credit is available to all Arizona individual taxpayers regardless of whether or not they

have children in school. An individual can contribute and receive tax credit for any amount up to

$200, or a couple filing jointly can contribute up to $400.

Where does the money go? Does it have to be $400?

You may indicate which school and which program you would like to support or you can designate your money

to be given to the school(s) with the greatest need. The credit also may be split between one or more schools.

The amount of the tax credit you take does not have to be for the total allowable amount of $400 – you may

donate up to your $200 or $400 limit in installments during the calendar year or donate it at one time.

How can I take advantage of the tax credit?

ONLINE: Visit the District website at and click on the “District” drop down menu and select

“Tax Credit Online”

MAIL: Complete and return this form with your non-refundable check payable to Avondale Elementary School District

#44, by April 15, 2016, to 295 W. Western Avenue, Avondale, AZ 85323. Mailed tax credit request forms must be

postmarked by April 15, 2016. Call 623-772-5003 for further information.

---------------------------------------------------------------------------------------------------

Avondale Elementary School District #44

2015 Tax Credit Contribution Form

Name

SSN (optional)

Mailing Address

Phone

City/State/Zip

Date

Please indicate the amount, school and activity you would like your contribution to support:

_____ $25

_____ $50

_____ $100

_____ $200

_____ $400

_____ Other

_________

Avondale Middle School

__________ STAR Academy (

)

Alternative Education Program

_________

Centerra Mirage School

__________ Athletics

_________

Copper Trails School

__________ Music

_________

Desert Star School

__________ Fine Arts

_________

Desert Thunder School

__________ Field Trips

_________

Eliseo C. Felix School

__________ Character Education

_________

Lattie Coor School

__________ School May Designate

_________

Michael Anderson School

_________

Wildflower School

48

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1