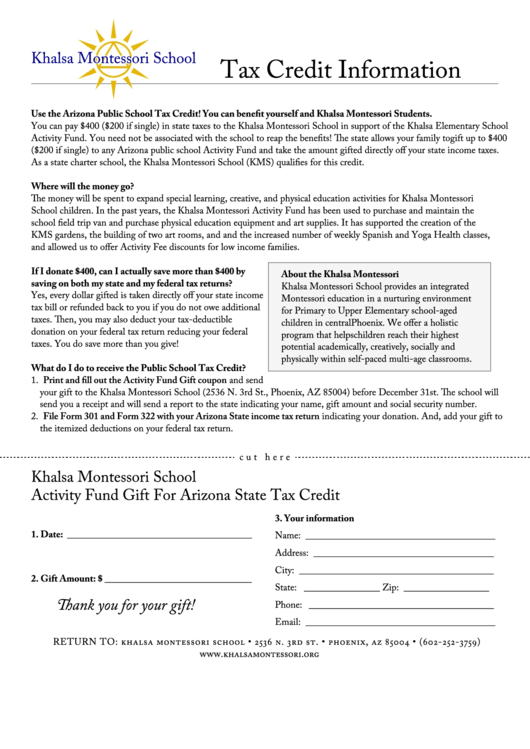

Khalsa Montessori School Activity Fund Gift For Arizona State Tax Credit

ADVERTISEMENT

Khalsa Montessori School

Khalsa Montessori School

Tax Credit Information

Use the Arizona Public School Tax Credit! You can benefit yourself and Khalsa Montessori Students.

You can pay $400 ($200 if single) in state taxes to the Khalsa Montessori School in support of the Khalsa Elementary School

Activity Fund. You need not be associated with the school to reap the benefits! The state allows your family to gift up to $400

($200 if single) to any Arizona public school Activity Fund and take the amount gifted directly off your state income taxes.

As a state charter school, the Khalsa Montessori School (KMS) qualifies for this credit.

Where will the money go?

The money will be spent to expand special learning, creative, and physical education activities for Khalsa Montessori

School children. In the past years, the Khalsa Montessori Activity Fund has been used to purchase and maintain the

school field trip van and purchase physical education equipment and art supplies. It has supported the creation of the

KMS gardens, the building of two art rooms, and and the increased number of weekly Spanish and Yoga Health classes,

and allowed us to offer Activity Fee discounts for low income families.

If I donate $400, can I actually save more than $400 by

About the Khalsa Montessori School...

saving on both my state and my federal tax returns?

Khalsa Montessori School provides an integrated

Yes, every dollar gifted is taken directly off your state income

Montessori education in a nurturing environment

tax bill or refunded back to you if you do not owe additional

for Primary to Upper Elementary school-aged

taxes. Then, you may also deduct your tax-deductible

children in central Phoenix. We offer a holistic

donation on your federal tax return reducing your federal

program that helps children reach their highest

taxes. You do save more than you give!

potential academically, creatively, socially and

physically within self-paced multi-age classrooms.

What do I do to receive the Public School Tax Credit?

1. Print and fill out the Activity Fund Gift coupon and send

your gift to the Khalsa Montessori School (2536 N. 3rd St., Phoenix, AZ 85004) before December 31st. The school will

send you a receipt and will send a report to the state indicating your name, gift amount and social security number.

2. File Form 301 and Form 322 with your Arizona State income tax return indicating your donation. And, add your gift to

the itemized deductions on your federal tax return.

c u t h e r e

Khalsa Montessori School

Activity Fund Gift For Arizona State Tax Credit

3. Your information

1. Date: _______________________________________

Name: ________________________________________

Address: ______________________________________

City: _________________________________________

2. Gift Amount: $ _______________________________

State: ________________ Zip: __________________

Thank you for your gift!

Phone: _______________________________________

Email: ________________________________________

RETURN TO: KHALSA MONTESSORI SCHOOL • 2536 N. 3RD ST. • PHOENIX, AZ 85004 • (602-252-3759)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1