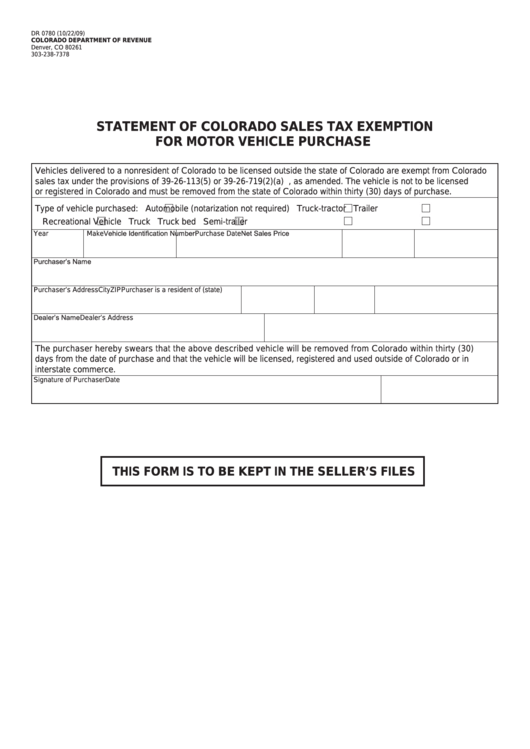

Form Dr 0780 - Statement Of Colorado Sales Tax Exemption For Motor Vehicle Purchas

ADVERTISEMENT

DR 0780 (10/22/09)

COLORadO dEPaRTMENT OF REvENuE

Denver, CO 80261

303-238-7378

STaTEMENT OF COLORadO SaLES Tax ExEMPTION

FOR MOTOR vEHICLE PuRCHaSE

Vehicles delivered to a nonresident of Colorado to be licensed outside the state of Colorado are exempt from Colorado

sales tax under the provisions of 39-26-113(5) or 39-26-719(2)(a) C.R.S., as amended. The vehicle is not to be licensed

or registered in Colorado and must be removed from the state of Colorado within thirty (30) days of purchase.

Type of vehicle purchased:

Automobile (notarization not required)

Truck-tractor

Trailer

Recreational Vehicle

Truck

Truck bed

Semi-trailer

Vehicle Identification Number

Net Sales Price

Year

Make

Purchase Date

Purchaser’s Name

Purchaser’s Address

City

ZIP

Purchaser is a resident of (state)

Dealer’s Name

Dealer’s Address

The purchaser hereby swears that the above described vehicle will be removed from Colorado within thirty (30)

days from the date of purchase and that the vehicle will be licensed, registered and used outside of Colorado or in

interstate commerce.

Signature of Purchaser

Date

THIS FORM IS TO BE KEPT IN THE SELLER’S FILES

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1