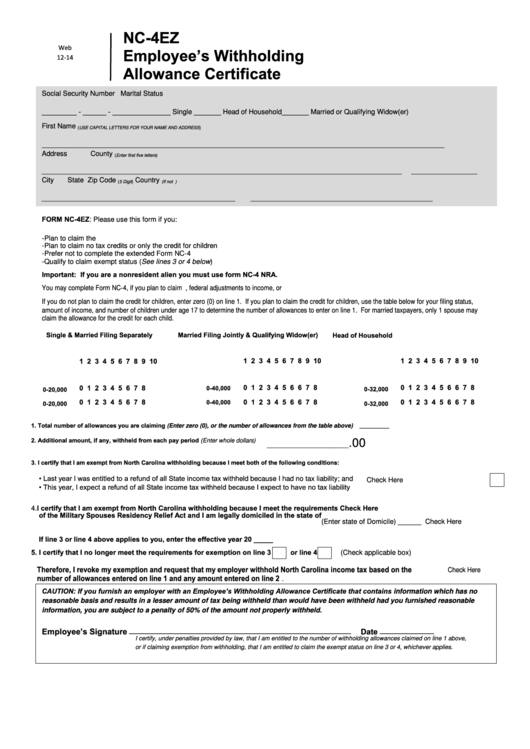

NC-4EZ

Web

Employee’s Withholding

12-14

Allowance Certificate

Social Security Number

Marital Status

_________ - ______ - _________

______ Single _______ Head of Household

_______ Married or Qualifying Widow(er)

First Name

M.I.

Last Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

_________________________________________________

_____

__________________________________________________

Address

County

(Enter first five letters)

_____________________________________________________________________________________________

_________________

City

State

Zip Code

Country

(5 Digit)

(If not U.S.)

__________________________________________________

____________

_____________

______________________

FORM NC-4EZ: Please use this form if you:

-Plan to claim the N.C. standard deduction

-Plan to claim no tax credits or only the credit for children

-Prefer not to complete the extended Form NC-4

-Qualify to claim exempt status (See lines 3 or 4 below)

Important: If you are a nonresident alien you must use form NC-4 NRA.

You may complete Form NC-4, if you plan to claim N.C. itemized deductions, federal adjustments to income, or N.C. deductions.

If you do not plan to claim the credit for children, enter zero (0) on line 1. If you plan to claim the credit for children, use the table below for your filing status,

amount of income, and number of children under age 17 to determine the number of allowances to enter on line 1. For married taxpayers, only 1 spouse m ay

claim the allowance for the credit for each child.

Single & Married Filing Separately

Married Filing Jointly & Qualifying Widow(er)

Head of Household

Income

# of Children Under age 17

Income

# of Children Under age 17

Income

# of Children Under age 17

1 2 3 4 5 6 7 8 9 10

1 2 3 4 5 6 7 8 9 10

1 2 3 4 5 6 7 8 9 10

# of Allowances

# of Allowances

# of Allowances

0 1 2 3 4 5 6 6 7 8

0 1 2 3 4 5 6 6 7 8

0 1 2 3 4 5 6 7 8

0-40,000

0-32,000

0-20,000

0 1 2 3 4 5 6 7 8

0 1 2 3 4 5 6 6 7 8

0 1 2 3 4 5 6 6 7 8

0-40,000

0-20,000

0-32,000

1. Total number of allowances you are claiming (Enter zero (0), or the number of allowances from the table above)

_________

2. Additional amount, if any, withheld from each pay period (Enter whole dollars)

.00

_____________________

3. I certify that I am exempt from North Carolina withholding because I meet both of the following conditions:

• Last year I was entitled to a refund of all State income tax withheld because I had no tax liability; and

Check Here

• This year, I expect a refund of all State income tax withheld because I expect to have no tax liability

4. I certify that I am exempt from North Carolina withholding because I meet the requirements Check Here

of the Military Spouses Residency Relief Act and I am legally domiciled in the state of

(Enter state of Domicile) ______ Check Here

If line 3 or line 4 above applies to you, enter the effective year 20 _____

5. I certify that I no longer meet the requirements for exemption on line 3

or line 4

(Check applicable box)

Therefore, I revoke my exemption and request that my employer withhold North Carolina income tax based on the

Check Here

number of allowances entered on line 1 and any amount entered on line 2.

CAUTION: If you furnish an employer with an Employee’s Withholding Allowance Certificate that contains information which has no

reasonable basis and results in a lesser amount of tax being withheld than would have been withheld had you furnished reasonable

information, you are subject to a penalty of 50% of the amount not properly withheld.

_________________________________________________________

______________

Employee’s Signature

Date

I certify, under penalties provided by law, that I am entitled to the number of withholding allowances claimed on line 1 above,

or if claiming exemption from withholding, that I am entitled to claim the exempt status on line 3 or 4, whichever applies.

1

1