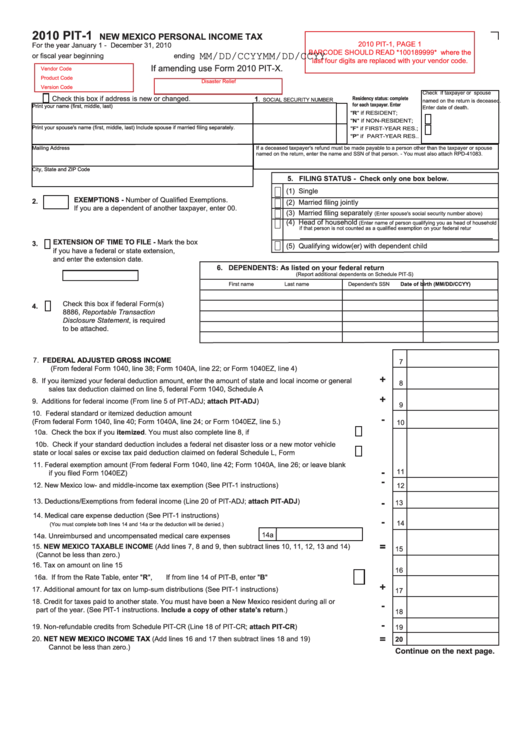

2010 - Pit-1 - New Mexico Personal Income Tax

ADVERTISEMENT

2010 PIT-1

NEW MEXICO PERSONAL INCOME TAX

2010 PIT-1, PAGE 1

For the year January 1 - December 31, 2010

BARCODE SHOULD READ *100189999* where the

MM/DD/CCYY

MM/DD/CCYY

RU ¿VFDO \HDU EHJLQQLQJ

ending

.

last four digits are replaced with your vendor code.

If amending use Form 2010 PIT-X.

Vendor Code

Product Code

Disaster Relief

Version Code

Check if taxpayer or spouse

Check this box if address is new or changed.

Residency status: complete

1

. SOCIAL SECURITY NUMBER

named on the return is deceased.

for each taxpayer. Enter

3ULQW \RXU QDPH

¿UVW PLGGOH ODVW

Enter date of death.

"R" if RESIDENT;

"N" if NON-RESIDENT;

3ULQW \RXU VSRXVH

V QDPH

¿UVW PLGGOH ODVW

,QFOXGH VSRXVH LI PDUULHG ¿OLQJ VHSDUDWHO\

"F" if FIRST-YEAR RES.;

"P" if PART-YEAR RES..

If a deceased taxpayer's refund must be made payable to a person other than the taxpayer or spouse

Mailing Address

named on the return, enter the name and SSN of that person. - You must also attach RPD-41083.

City, State and ZIP Code

5. FILING STATUS - Check only one box below.

(1) Single

EXEMPTIONS - 1XPEHU RI 4XDOL¿HG ([HPSWLRQV

2.

0DUULHG ¿OLQJ MRLQWO\

If you are a dependent of another taxpayer, enter 00.

0DUULHG ¿OLQJ VHSDUDWHO\

(Enter spouse's social security number above)

(4) Head of household

(Enter name of person qualifying you as head of household

LI WKDW SHUVRQ LV QRW FRXQWHG DV D TXDOL¿HG H[HPSWLRQ RQ \RXU IHGHUDO UHWXUQ

EXTENSION OF TIME TO FILE - Mark the box

3.

(5) Qualifying widow(er) with dependent child

if you have a federal or state extension,

and enter the extension date.

6. DEPENDENTS: As listed on your federal return

(Report additional dependents on Schedule PIT-S)

First name

Last name

Dependent's SSN

Date of birth (MM/DD/CCYY)

Check this box if federal Form(s)

4.

8886, Reportable Transaction

Disclosure Statement, is required

to be attached.

7.

FEDERAL ADJUSTED GROSS INCOME ....................................................................................................

7

(From federal Form 1040, line 38; Form 1040A, line 22; or Form 1040EZ, line 4)

+

8.

If you itemized your federal deduction amount, enter the amount of state and local income or general

8

sales tax deduction claimed on line 5, federal Form 1040, Schedule A ........................................................

+

9.

Additions for federal income (From line 5 of PIT-ADJ; attach PIT-ADJ) ......................................................

9

10. Federal standard or itemized deduction amount

-

(From federal Form 1040, line 40; Form 1040A, line 24; or Form 1040EZ, line 5.) .......................................

10

10a. Check the box if you itemized. You must also complete line 8, if applicable.................................

10b. Check if your standard deduction includes a federal net disaster loss or a new motor vehicle

state or local sales or excise tax paid deduction claimed on federal Schedule L, Form 1040......

11. Federal exemption amount (From federal Form 1040, line 42; Form 1040A, line 26; or leave blank

-

11

LI \RX ¿OHG )RUP (=

...............................................................................................................................

-

12. New Mexico low- and middle-income tax exemption (See PIT-1 instructions) ..............................................

12

13. Deductions/Exemptions from federal income (Line 20 of PIT-ADJ; attach PIT-ADJ) ..................................

-

13

14. Medical care expense deduction (See PIT-1 instructions) .............................................................................

-

14

(You must complete both lines 14 and 14a or the deduction will be denied.)

14a

14a. Unreimbursed and uncompensated medical care expenses ........

=

15. NEW MEXICO TAXABLE INCOME (Add lines 7, 8 and 9, then subtract lines 10, 11, 12, 13 and 14) .........

15

(Cannot be less than zero.)

16. Tax on amount on line 15 ................................................................................................................................

16

16a. If from the Rate Table, enter "R",

If from line 14 of PIT-B, enter "B".........................................

+

17. Additional amount for tax on lump-sum distributions (See PIT-1 instructions) ..............................................

17

18. Credit for taxes paid to another state. You must have been a New Mexico resident during all or

-

part of the year. (See PIT-1 instructions. Include a copy of other state's return.) ....................................

18

-

19. Non-refundable credits from Schedule PIT-CR (Line 18 of PIT-CR; attach PIT-CR) ...................................

19

=

20.

NET NEW MEXICO INCOME TAX

(Add lines 16 and 17 then subtract lines 18 and 19) .............................

20

Cannot be less than zero.)

Continue on the next page.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2