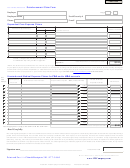

Fsa Reimbursement Form - Healthtrust Page 2

ADVERTISEMENT

INSTRUCTIONS

1. Complete all applicable sections of this form and attach proof of expense that shows date incurred,

amount you are responsible for, provider name and description of service. Accepted as proof of expense

are: itemized invoice, receipt of payment from provider or insurance, and Explanation of Benefits form. The

receipt for prescription drugs should include the prescription name or NDC#, date the prescription was filled,

patient name and cost. A receipt for an over-the-counter item must be a printed receipt that includes the name

of the item (handwritten over-the-counter item names are unacceptable), the price and date purchased. The

Dependent Care Provider’s Certification of Services Rendered may be used as proof of expense. Canceled

checks are not acceptable.

2. Your Healthcare FSA or Dependent Care Reimbursement Account may only be used to reimburse expenses

incurred during the plan year (or during the 2½-month grace period immediately following the plan year if

elected by your employer) for which an election is in force. An expense is incurred at the time a service is

furnished and not when you are billed, charged for, or pay for the service.

3. Mail or fax the form, plus attachment(s), to HealthTrust at the address noted below. HealthTrust processes

reimbursements on a weekly basis. Completed reimbursement forms that are received by the end of the day

on Tuesday generally will be processed for reimbursement on Thursday. Incomplete reimbursement forms

may be delayed or returned.

4. The amount available for reimbursement of Dependent Care expenses will not exceed the amount credited

to your Dependent Care Reimbursement Account to that date, reduced by prior reimbursements for the

same period of coverage. Any expenses claimed in excess of your account balance will be carried over and

reimbursed when sufficient additional monies are credited to your account. Healthcare FSA reimbursements

are paid in full, not to exceed the yearly total.

5. Dependent Care reimbursement requests must include the provider’s name and Taxpayer ID or Social

Security number.

6. Reimbursement requests may be submitted for up to 90 days after the plan year (or the 2 ½-month grace

period) ends. Amounts not so claimed will be forfeited.

7. The minimum check amount for reimbursement is $20 unless it is for your last claim of the plan year.

8. A detailed list of eligible healthcare expenses is contained in the Plan Document, available from your employer,

or by following the Flexible Account Spending link at

MAIL OR FAX COMPLETED FORM TO:

HealthTrust

Attn: FSA Reimbursement

PO Box 617

Concord, NH 03302

603.415.3099 (fax)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2