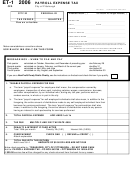

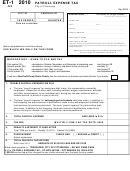

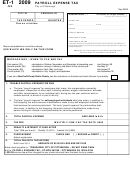

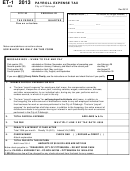

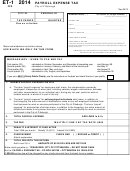

Form Et-1 - Payroll Expense Tax - City Of Pittsburgh - 2014 Page 2

ADVERTISEMENT

WHO MUST FILE

Every employer conducting business in the City of Pittsburgh is required to file a Payroll Tax on their

payroll expense and on their own net earnings distributions to each partner, sole proprietor or

individual performing services within the City of Pittsburgh. A person shall be deemed to be

conducting business within the City of Pittsburgh if one engages, hires, employs or contracts with

one or more individuals as employees or is self-employed. Form can be downloaded at

COMPENSATION MEANS

Salaries, wages, commissions, bonuses, stock options, and all types of incentive payments,

whether based on profits or otherwise, fees, tips and similar remuneration earned, whether paid

directly or through an agent, and whether in cash or in property.

WHEN TO FILE AND PAY

The Payroll Expense Tax is to be paid as follows:

First quarter calculated on October, November, and December of preceding year due February 28.

Second quarter calculated on January, February, and March of the current year due May 31.

Third quarter calculated on April, May, and June due August 31.

Fourth quarter calculated on July, August, and September due November 30.

A 501C-3 Non-Profit Purely Public Charitable Organization shall calculate the tax that would

otherwise be attributable to the City of Pittsburgh and file a return, but shall only pay the tax on

that portion of its payroll expense attributable to business activity for which a tax may be imposed

pursuant to Section 511 of the Internal Revenue Code.

If the charity has purchased or is

operating branches, affiliates, subsidiaries or other business entities that do not independently

meet the standards of the “Institutions of Purely Public Charity Act”, the tax shall be paid on the

payroll attributable to such for-profit branches, affiliates or subsidiaries, whether or not the

employees are leased or placed under the auspices of the charity’s umbrella or parent

organization.

A current copy of the Federal 990 tax return and Non-Profit Charter may be

requested to support your claim of a Purely Public Charity.

On Line 1 (a) enter the total Payroll Expense that would be taxable if entity were not a Purely

Public Charity.

On Line 2 enter the total taxable Payroll Expense, if applicable.

On Line 3 enter tax due.

On Line 6 enter the amount of tax owed and paid. Attach a worksheet showing what is taxable and

what is not taxable.

Has business been sold or discontinued?

If YES, a BUSINESS DISCONTINUATION FORM must be completed and returned for processing.

Form and Regulations can be downloaded at

or call 412-255-2510 to request the form.

Make check payable to:

TREASURER, CITY OF PITTSBURGH

– DO NOT SEND CASH –

WRITE YOUR CITY ACCOUNT NUMBER ON YOUR CHECK

A $30.00 fee will be assessed for any check returned from the bank for any reason.

MAIL TO

PAYMENT ENCLOSED - ET

NO PAYMENT ENCLOSED – ET

TREASURER CITY OF PITTSBURGH

TREASURER CITY OF PITTSBURGH

PO BOX 643780

414 GRANT ST

PITTSBURGH PA 15264-3780

PITTSBURGH PA 15219-2476

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2