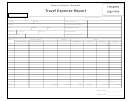

American Council On Education Domestic Travel Expense Report Page 2

ADVERTISEMENT

Total Dates Away:

4

Number of Days on Business:

2

Individual Amounts

Attach Receipts

Description/Explanation

Date

Meals &

Total

Trans. Air,

Comments and Mileage Computation

Lodging

Incidentals or

Misc.

Taxis, etc.

Per Diem

Lodging- MGM Grand plus taxes

4/3/2015

$

99.00

$

34.28

$

133.28

Meal per diem travel day- $71 x .75%

$

53.25

$

53.25

$

-

4/4/2015

Lodging- MGM Grand plus taxes

$

99.00

$

34.28

$

133.28

Meal per diem review day

$

71.00

$

71.00

4/5/2015

Lodging- MGM Gran plus taxes

$

99.00

$

34.28

$

133.28

Meal per diem review day

$

71.00

$

71.00

$

-

Meal per diem travel day- $71 x .75%

4/6/2015

$

53.25

$

53.25

$

-

4/3/2015

POV mileage to the airport 56 x .575

$

32.20

$

32.20

$

-

4/6/2015

POV mileage from the airport 56 x .575

$

32.20

$

32.20

$

-

4/6/2015 Parking

$

48.00

$

48.00

$

-

4/6/2015 Rental Car

$

104.51

$

104.51

4/5/2015 Rental car gas

$

6.78

$

6.78

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

$

-

Total Accounted for

$

223.69

$

297.00

$

248.50

$

102.84

$

872.03

Deduct Personal Charges

$

-

Total Reimbursable Charges (to front page)

$

223.69

$

297.00

$

248.50

$

102.84

$

872.03

List those items paid directly by ACE

(i.e., airline tickets, registration fees, hotel charges, etc.)

Date

Amount

Billed by

Project

04/03/15

$

470.00

AMEX Flight

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2