Print Form

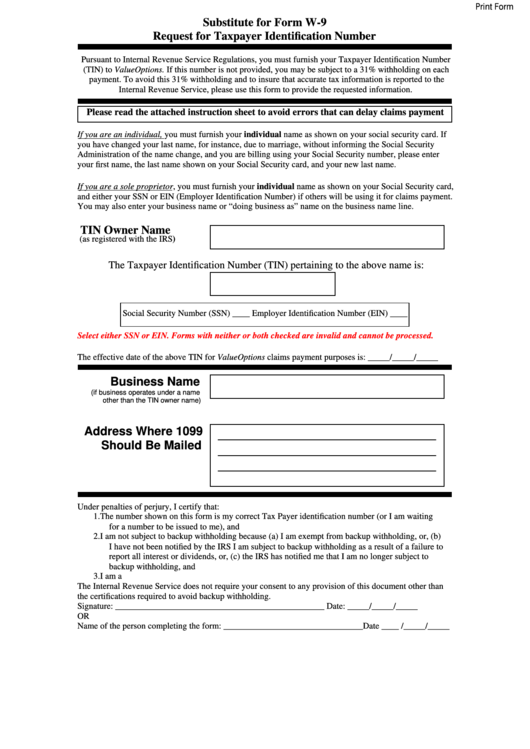

Substitute for Form W-9

Request for Taxpayer Identification Number

Pursuant to Internal Revenue Service Regulations, you must furnish your Taxpayer Identification Number

(TIN) to ValueOptions. If this number is not provided, you may be subject to a 31% withholding on each

payment. To avoid this 31% withholding and to insure that accurate tax information is reported to the

Internal Revenue Service, please use this form to provide the requested information.

Please read the attached instruction sheet to avoid errors that can delay claims payment

If you are an individual, you must furnish your individual name as shown on your social security card. If

you have changed your last name, for instance, due to marriage, without informing the Social Security

Administration of the name change, and you are billing using your Social Security number, please enter

your first name, the last name shown on your Social Security card, and your new last name.

If you are a sole proprietor, you must furnish your individual name as shown on your Social Security card,

and either your SSN or EIN (Employer Identification Number) if others will be using it for claims payment.

You may also enter your business name or “doing business as” name on the business name line.

TIN Owner Name

(as registered with the IRS)

The Taxpayer Identification Number (TIN) pertaining to the above name is:

Social Security Number (SSN) ____ Employer Identification Number (EIN) ____

Select either SSN or EIN. Forms with neither or both checked are invalid and cannot be processed.

The effective date of the above TIN for ValueOptions claims payment purposes is: _____/_____/_____

Business Name

(if business operates under a name

other than the TIN owner name)

Address Where 1099

Should Be Mailed

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct Tax Payer identification number (or I am waiting

for a number to be issued to me), and

2. I am not subject to backup withholding because (a) I am exempt from backup withholding, or, (b)

I have not been notified by the IRS I am subject to backup withholding as a result of a failure to

report all interest or dividends, or, (c) the IRS has notified me that I am no longer subject to

backup withholding, and

3. I am a U.S. citizen or U.S. resident alien.

The Internal Revenue Service does not require your consent to any provision of this document other than

the certifications required to avoid backup withholding.

Signature: ________________________________________________ Date: _____/_____/_____

OR

Name of the person completing the form: ________________________________Date ____ /_____/_____

1

1 2

2