Substitute Form W-9 - Request For Taxpayer Identification Number

ADVERTISEMENT

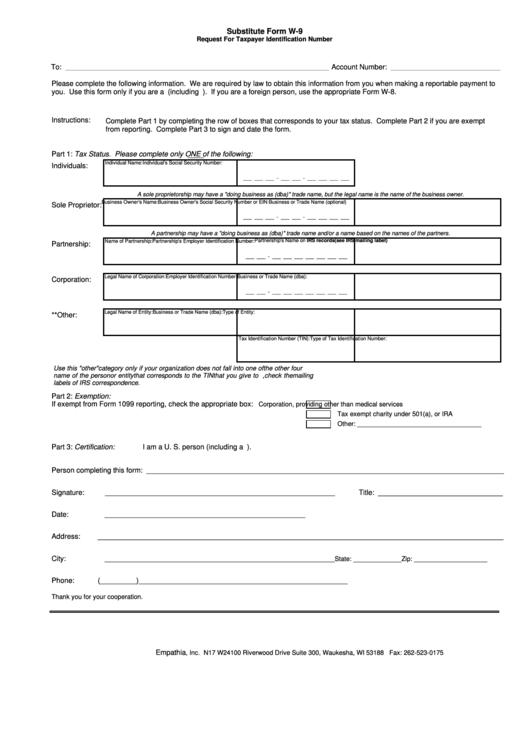

Substitute Form W-9

Request For Taxpayer Identification Number

To: _____________________________________________________________________

Account Number: ____________________________

Please complete the following information. We are required by law to obtain this information from you when making a reportable payment to

you. Use this form only if you are a U.S. person (including U.S. resident alien). If you are a foreign person, use the appropriate Form W-8.

Instructions:

Complete Part 1 by completing the row of boxes that corresponds to your tax status. Complete Part 2 if you are exempt

from reporting. Complete Part 3 to sign and date the form.

Part 1: Tax Status. Please complete only ONE of the following:

Individual Name:

Individual's Social Security Number:

Individuals:

___ ___ ___ - ___ ___ - ___ ___ ___ ___

A sole proprietorship may have a "doing business as (dba)" trade name, but the legal name is the name of the business owner.

Business Owner's Name:

Business Owner's Social Security Number or EIN:

Business or Trade Name (optional)

Sole Proprietor:

___ ___ ___ - ___ ___ - ___ ___ ___ ___

A partnership may have a "doing business as (dba)" trade name and/or a name based on the names of the partners.

Partnership's Name on IRS records(see IRS mailing label)

Name of Partnership:

Partnership's Employer Identification Number:

Partnership:

___ ___ - ___ ___ ___ ___ ___ ___ ___

Legal Name of Corporation:

Employer Identification Number:

Business or Trade Name (dba):

Corporation:

___ ___ - ___ ___ ___ ___ ___ ___ ___

Legal Name of Entity:

Business or Trade Name (dba):

Type of Entity:

**Other:

Tax Identification Number (TIN):

Type of Tax Identification Number:

Use this "other" category only if your organization does not fall into one of the other four categories. If you chose this option you must provide the legal

name of the person or entity that corresponds to the TIN that you give to us. If uncertain what the legal name of your corporation is, check the mailing

labels of IRS correspondence.

Part 2: Exemption:

If exempt from Form 1099 reporting, check the appropriate box:

Corporation, providing other than medical services

Tax exempt charity under 501(a), or IRA

Other: __________________________________

Part 3: Certification:

I am a U. S. person (including a U.S. resident alien).

Person completing this form: _________________________________________________________________________________________

Signature:

Title: _______________________________

_______________________________________________________________

Date:

_______________________________________________________

Address:

_____________________________________________________________________________________________________

City:

____________

_______________________________________________________________State:

Zip: ____________________

Phone:

(_________)____________________________________________________

Thank you for your cooperation.

Empathia

, Inc. N17 W24100 Riverwood Drive Suite 300, Waukesha, WI 53188 Fax: 262-523-0175

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1