Instructions For Application And Verification Form For Residential Energy Tax Credit Page 2

ADVERTISEMENT

Take the following steps to receive your tax credit:

1.

Verify that the stove or direct vent fireplace you are purchasing is eligible for an Oregon tax credit. Look up the stove you

intend to purchase by manufacturer and model number for wood and pellet stove is available from the United States

Department Environmental Protection Agency's List of EPA Certified Wood Stoves at

2.

Install the stove with dedicated outside air for combustion. To qualify for the Oregon Residential Tax Credit your stove must be

installed with outside combustion air and have an approved carbon monoxide detector alarm device installed in your home.

3.

Attach a copy of your final itemized receipt showing the full model number of your stove. Your receipt must clearly show the

date, name of the stove dealer, full make and model of the stove and the amount paid.

4.

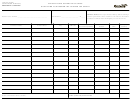

Submit a completed Application and Verification Form for Tax Credit Certification - Premium Efficiency Wood & Pellet Stoves.

Be sure to list the model of the stove as it appears on the EPA Certified Wood Heater List, indicate the method of outside air and

include your Social Security Number. We cannot process your application without this information. Mail your application to the

Department of Energy to the address listed on the back of the application.

5.

Claim the tax credit on your state income tax form. Keep your certification postcard, a copy of your application, and proof of

payment with your tax records. Do not attach the certification postcard to your tax return. Upon audit or examination, the

information shall be made available to the Oregon Department of Revenue to verify any credit claimed. Tax credits not taken in

the first tax year may be carried forward for up to five years.

Eligibility for the Oregon Residential Energy Tax Credit

To qualify for the Oregon Residential Energy Tax Credit, you must be an Oregon resident and the equipment

must be located in an Oregon dwelling that is your primary or secondary (vacation) residence or property for

which you are the landlord.

The tax credit issued normally applies to the tax year the equipment was purchased or placed in service, as

st

long as it is placed in service by April 1

of the following year and the Oregon Department of Energy has

received your completed application by that date.

The Oregon Department of Energy verifies the energy efficiency of systems and equipment for the Oregon

Residential Energy Tax Credit program. It is the applicant’s responsibility to ensure compliance with all other

eligibility requirements.

Note: Your Social Security Number is required to process your tax credit application. It is used to establish

your identity for tax purposes only and is authorized by Section 405, Title 42 of the United States Code.

We cannot process your application without it.

Pass-through Option

The Residential Energy Tax Credit Pass-through Option allows an individual, estate or trust subject to tax

under ORS chapter 316 who purchases a qualifying device (a homeowner) to transfer their Residential Energy

Tax Credit to another individual subject to Oregon personal income tax under ORS 316 (a pass-through

partner). You and your pass-through partner (the tax credit recipient) will complete and sign the Pass-

through Option Application and mail it to the Oregon Department of Energy. The pass-through option is a

one-time transfer and is final. The Department of Energy will then issue the tax credit certification to the

pass-through partner.

The pass-through option is a one-time transfer and is final. There may be tax implications. We advise you

to consult with your tax preparer or call the Department of Revenue.

If you have questions concerning claiming the credit on your Oregon tax return, contact the Oregon

Department of Revenue at 1-800-356-4222 or (503)378-4988.

If you have any questions about equipment eligibility or the tax credit application process, please see the

Oregon Department of Energy Web site:

or call us toll-free: 1-800-221-8035. In

Salem, please call (503) 378-4040.

05/15 ODOE CF-181

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4