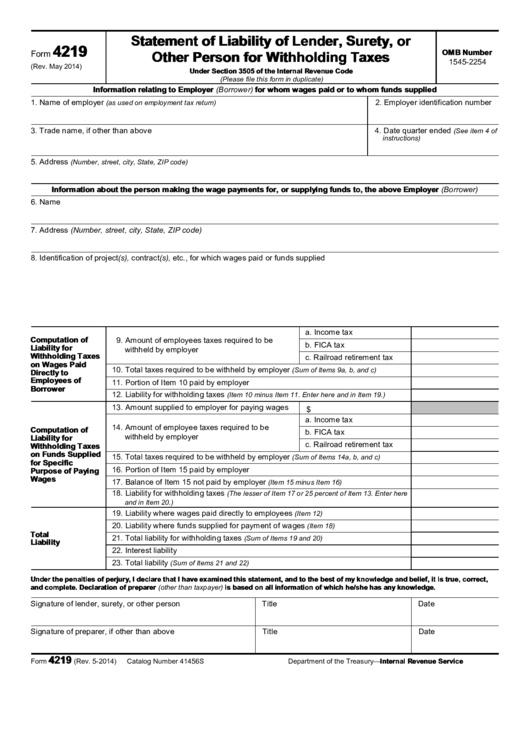

Statement of Liability of Lender, Surety, or

4219

OMB Number

Form

Other Person for Withholding Taxes

1545-2254

(Rev. May 2014)

Under Section 3505 of the Internal Revenue Code

(Please file this form in duplicate)

Information relating to Employer (Borrower) for whom wages paid or to whom funds supplied

1. Name of employer

2. Employer identification number

(as used on employment tax return)

3. Trade name, if other than above

4. Date quarter ended

(See item 4 of

instructions)

5. Address

(Number, street, city, State, ZIP code)

Information about the person making the wage payments for, or supplying funds to, the above Employer (Borrower)

6. Name

7. Address (Number, street, city, State, ZIP code)

8. Identification of project(s), contract(s), etc., for which wages paid or funds supplied

a. Income tax

Computation of

9. Amount of employees taxes required to be

b. FICA tax

Liability for

withheld by employer

Withholding Taxes

c. Railroad retirement tax

on Wages Paid

10. Total taxes required to be withheld by employer

(Sum of Items 9a, b, and c)

Directly to

Employees of

11. Portion of Item 10 paid by employer

Borrower

12. Liability for withholding taxes

(Item 10 minus Item 11. Enter here and in Item 19.)

13. Amount supplied to employer for paying wages

$

a. Income tax

14. Amount of employee taxes required to be

Computation of

b. FICA tax

withheld by employer

Liability for

c. Railroad retirement tax

Withholding Taxes

on Funds Supplied

15. Total taxes required to be withheld by employer

(Sum of Items 14a, b, and c)

for Specific

16. Portion of Item 15 paid by employer

Purpose of Paying

Wages

17. Balance of Item 15 not paid by employer

(Item 15 minus Item 16)

18. Liability for withholding taxes

(The lesser of Item 17 or 25 percent of Item 13. Enter here

and in Item 20.)

19. Liability where wages paid directly to employees

(Item 12)

20. Liability where funds supplied for payment of wages

(Item 18)

Total

21. Total liability for withholding taxes

(Sum of Items 19 and 20)

Liability

22. Interest liability

23. Total liability

(Sum of Items 21 and 22)

Under the penalties of perjury, I declare that I have examined this statement, and to the best of my knowledge and belief, it is true, correct,

and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has any knowledge.

Signature of lender, surety, or other person

Title

Date

Signature of preparer, if other than above

Title

Date

4219

Form

(Rev. 5-2014)

Catalog Number 41456S

Department of the Treasury—Internal Revenue Service

1

1 2

2