Form Deq 50-11s Recycling Machinery And Equipment Certification Page 2

ADVERTISEMENT

INSTRUCTIONS

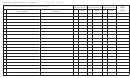

FORM DEQ 50-11S

GENERAL

For tax years beginning on and after January 1, 1993 but before January 1, 2015, those “C” Corporations which qualify under

Code of Virginia § 58.1-439.7 may receive an income tax credit for the purchase of machinery and equipment used exclusively in

or on the premises of manufacturing facilities or in plant units which manufacture, process, compound or produce items of

tangible personal property from recyclable materials, within the Commonwealth. For those “C” Corporations qualifying under §

58.1-439.8 of the Code of Virginia, the tax years are on and after January 1, 1998 but before January 1, 2003. The credit is an

amount equal to ten percent of the purchase price paid during the taxable year, but shall not exceed forty percent of the Virginia

income tax liability of such taxpay er (Code of Virginia § 58.1-439.7), or sixty percent of the Virginia income tax liability for

those corporations qualifying under § 58.1-439.8 of the Code of Virginia. This is a nonrefundable credit, however, if the

allowable credit exceeds the Virginia tax liability for the taxable year in which the purchase price on recycling machinery and

equipment was paid, it may be carried over for credit against the corporation’s income taxes in the ten succeeding taxable years

until the total credit is used (Code of Virginia § 58.1-439.7), or in the case of those corporations qualifying under § 58.1-439.8 of

the Code of Virginia, twenty succeeding years.

Individuals and “Pass-through” Corporations are both entitled to claim the credit for certified equipment purchased after January

1, 2008.

The machinery and equipment must be certified by the Department of Environmental Quality as integral to the recycling process

in accordance with §§ 58.1-439.7 and 439.8 of the Code of Virginia. Refer also to the Guidance for the Certification of

Recycling Machinery and Equipment for State Income Tax Credit Under Sections 58.1-439.7 and 58.1-439.8 of the Code of

Virginia)

The Department of Environmental Quality has developed this form to assist persons applying for the machinery and equipment

certification, and to expedite the certification process. However, you are not required to use this form to apply for certification.

LOCAL TAX OPTION

Once certified, the machinery and equipment may also qualify for a local tax exemption based on current value assessment by

taxing authority. Contact your local governing body for information.

PART I

Enter the name, address, phone number, and tax ID, of the individual or corporation as it appears on the Virginia income tax

return.

PART II

Enter the name and physical address of the facility where the machinery and equipment are located. Provide a detailed

description of the machinery and equipment and its intended use in the facility with drawings, specifications and operating

parameters.

Attach any necessary descriptions or documents which demonstrate the use of the machinery and equipment. Mail the completed

form and attachments to the address below:

Department of Environmental Quality

Waste Technical Support Office

Attention: Machinery and Equipment Certification Officer

PO Box 1105

Richmond, VA 23218

For assistance call:

804-698-4145

Department of Environmental Quality

804-698-4021

TDD

Upon certification, the form and attachments will be returned to you. In order to qualify for a state income tax credit, the form

(or other certification document) along with documentary proof of the purchase price paid (original cost plus other capitalized

costs incurred to put the machinery or equipment in service, but not including capitalized interest), will need to be attached to

your Virginia income tax return when filed with the Department of Taxation. For assistance on taxation matters call 804-225-

4265.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2