Dependent Care Account Claim Form

Download a blank fillable Dependent Care Account Claim Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Dependent Care Account Claim Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

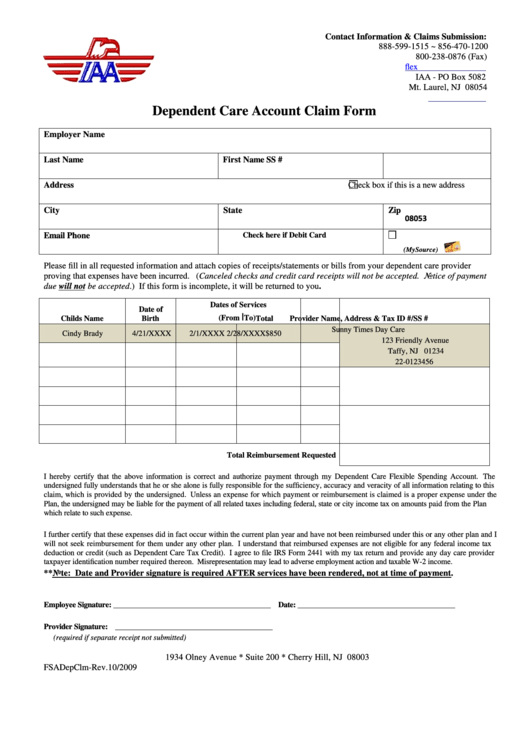

Contact Information & Claims Submission:

888-599-1515 ~ 856-470-1200

800-238-0876 (Fax)

IAA - PO Box 5082

Mt. Laurel, NJ 08054

Dependent Care Account Claim Form

Employer Name

Last Name

First Name

SS #

Address

Check box if this is a new address

City

State

Zip

08053

Check here if Debit Card

Email

Phone

(MySource)

Please fill in all requested information and attach copies of receipts/statements or bills from your dependent care provider

proving that expenses have been incurred. (Canceled checks and credit card receipts will not be accepted. Notice of payment

due will not be accepted.) If this form is incomplete, it will be returned to you.

Dates of Services

Date of

|

(From

To)

Childs Name

Birth

Total

Provider Name, Address & Tax ID #/SS #

Sunny Times Day Care

Cindy Brady

4/21/XXXX

2/1/XXXX

2/28/XXXX

$850

123 Friendly Avenue

Taffy, NJ 01234

22-0123456

Total Reimbursement Requested

I hereby certify that the above information is correct and authorize payment through my Dependent Care Flexible Spending Account. The

undersigned fully understands that he or she alone is fully responsible for the sufficiency, accuracy and veracity of all information relating to this

claim, which is provided by the undersigned. Unless an expense for which payment or reimbursement is claimed is a proper expense under the

Plan, the undersigned may be liable for the payment of all related taxes including federal, state or city income tax on amounts paid from the Plan

which relate to such expense.

I further certify that these expenses did in fact occur within the current plan year and have not been reimbursed under this or any other plan and I

will not seek reimbursement for them under any other plan. I understand that reimbursed expenses are not eligible for any federal income tax

deduction or credit (such as Dependent Care Tax Credit). I agree to file IRS Form 2441 with my tax return and provide any day care provider

taxpayer identification number required thereon. Misrepresentation may lead to adverse employment action and taxable W-2 income.

**Note: Date and Provider signature is required AFTER services have been rendered, not at time of payment.

Employee Signature: _________________________________________

Date: _________________________________________

Provider Signature: _________________________________________

(required if separate receipt not submitted)

1934 Olney Avenue * Suite 200 * Cherry Hill, NJ 08003

FSADepClm-Rev.10/2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2