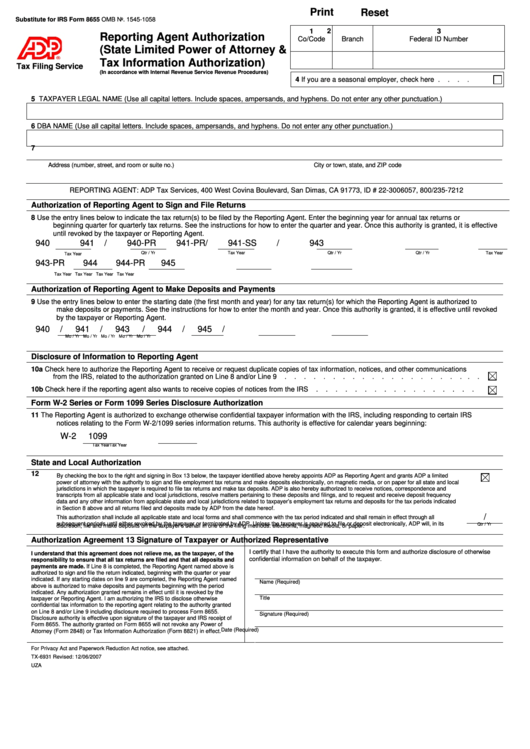

Print

Reset

Substitute for IRS Form 8655

OMB No. 1545-1058

1

2

3

Reporting Agent Authorization

Co/Code

Branch

Federal ID Number

(State Limited Power of Attorney &

Tax Information Authorization)

Tax Filing Service

(In accordance with Internal Revenue Service Revenue Procedures)

4

If you are a seasonal employer, check here .

.

.

.

5

TAXPAYER LEGAL NAME (Use all capital letters. Include spaces, ampersands, and hyphens. Do not enter any other punctuation.)

6

DBA NAME (Use all capital letters. Include spaces, ampersands, and hyphens. Do not enter any other punctuation.)

7

Address (number, street, and room or suite no.)

City or town, state, and ZIP code

REPORTING AGENT: ADP Tax Services, 400 West Covina Boulevard, San Dimas, CA 91773, ID # 22-3006057, 800/235-7212

Authorization of Reporting Agent to Sign and File Returns

8

Use the entry lines below to indicate the tax return(s) to be filed by the Reporting Agent. Enter the beginning year for annual tax returns or

beginning quarter for quarterly tax returns. See the instructions for how to enter the quarter and year. Once this authority is granted, it is effective

until revoked by the taxpayer or Reporting Agent.

940

941

/

940-PR

941-PR

/

941-SS

/

943

Tax Year

Qtr / Yr

Tax Year

Qtr / Yr

Qtr / Yr

Tax Year

943-PR

944

944-PR

945

Tax Year

Tax Year

Tax Year

Tax Year

Authorization of Reporting Agent to Make Deposits and Payments

9

Use the entry lines below to enter the starting date (the first month and year) for any tax return(s) for which the Reporting Agent is authorized to

make deposits or payments. See the instructions for how to enter the month and year. Once this authority is granted, it is effective until revoked

by the taxpayer or Reporting Agent.

940

/

941

/

943

/

944

/

945

/

Mo / Yr

Mo / Yr

Mo / Yr

Mo / Yr

Mo / Yr

Disclosure of Information to Reporting Agent

10a

Check here to authorize the Reporting Agent to receive or request duplicate copies of tax information, notices, and other communications

from the IRS, related to the authorization granted on Line 8 and/or Line 9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

. .

.

10b

Check here if the reporting agent also wants to receive copies of notices from the IRS

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Form W-2 Series or Form 1099 Series Disclosure Authorization

11

The Reporting Agent is authorized to exchange otherwise confidential taxpayer information with the IRS, including responding to certain IRS

notices relating to the Form W-2/1099 series information returns. This authority is effective for calendar years beginning:

W-2

1099

Tax Year

Tax Year

State and Local Authorization

12

By checking the box to the right and signing in Box 13 below, the taxpayer identified above hereby appoints ADP as Reporting Agent and grants ADP a limited

power of attorney with the authority to sign and file employment tax returns and make deposits electronically, on magnetic media, or on paper for all state and local

jurisdictions in which the taxpayer is required to file tax returns and make tax deposits. ADP is also hereby authorized to receive notices, correspondence and

transcripts from all applicable state and local jurisdictions, resolve matters pertaining to these deposits and filings, and to request and receive deposit frequency

data and any other information from applicable state and local jurisdictions related to taxpayer’s employment tax returns and deposits for the tax periods indicated

in Section 8 above and all returns filed and deposits made by ADP from the date hereof.

/

This authorization shall include all applicable state and local forms and shall commence with the tax period indicated and shall remain in effect through all

subsequent periods until either revoked by the taxpayer or terminated by ADP. Unless the taxpayer is required to file or deposit electronically, ADP will, in its

Qtr / Yr

discretion, file and make deposits on the taxpayer’s behalf in one of the filing methods: electronic, magnetic media, or paper.

Authorization Agreement

13 Signature of Taxpayer or Authorized Representative

I certify that I have the authority to execute this form and authorize disclosure of otherwise

I understand that this agreement does not relieve me, as the taxpayer, of the

confidential information on behalf of the taxpayer.

responsibility to ensure that all tax returns are filed and that all deposits and

payments are made. If Line 8 is completed, the Reporting Agent named above is

authorized to sign and file the return indicated, beginning with the quarter or year

indicated. If any starting dates on line 9 are completed, the Reporting Agent named

Name (Required)

above is authorized to make deposits and payments beginning with the period

indicated. Any authorization granted remains in effect until it is revoked by the

Title

taxpayer or Reporting Agent. I am authorizing the IRS to disclose otherwise

confidential tax information to the reporting agent relating to the authority granted

on Line 8 and/or Line 9 including disclosure required to process Form 8655.

Signature (Required)

Disclosure authority is effective upon signature of the taxpayer and IRS receipt of

Form 8655. The authority granted on Form 8655 will not revoke any Power of

Date (Required)

Attorney (Form 2848) or Tax Information Authorization (Form 8821) in effect.

For Privacy Act and Paperwork Reduction Act notice, see attached.

TX-6931 Revised: 12/06/2007

UZA

1

1 2

2