Form Il-W-4 - Employee'S Illinois Withholding Allowance Certificate And Instructions 2011

ADVERTISEMENT

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

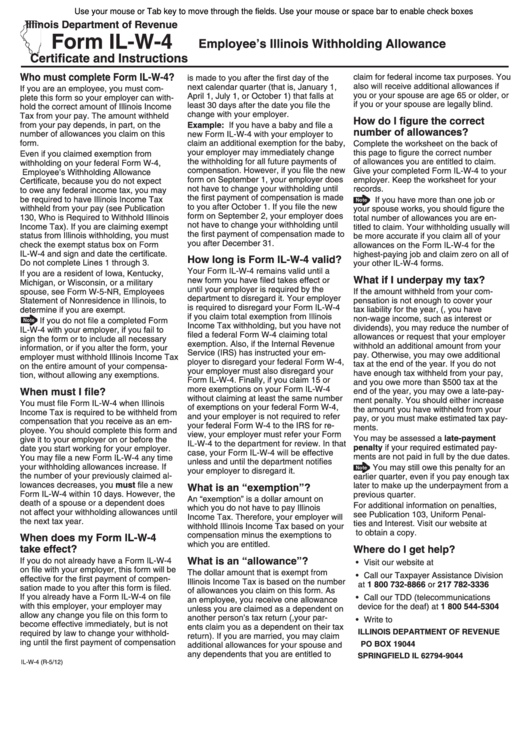

Illinois Department of Revenue

Form IL‑W‑4

Employee’s Illinois Withholding Allowance

Certificate and Instructions

Who must complete Form IL‑W‑4?

claim for federal income tax purposes. You

is made to you after the first day of the

also will receive additional allowances if

next calendar quarter (that is, January 1,

If you are an employee, you must com-

you or your spouse are age 65 or older, or

April 1, July 1, or October 1) that falls at

plete this form so your employer can with-

if you or your spouse are legally blind.

least 30 days after the date you file the

hold the correct amount of Illinois Income

change with your employer.

Tax from your pay. The amount withheld

How do I figure the correct

from your pay depends, in part, on the

Example: If you have a baby and file a

number of allowances?

number of allowances you claim on this

new Form IL-W-4 with your employer to

form.

claim an additional exemption for the baby,

Complete the worksheet on the back of

your employer may immediately change

this page to figure the correct number

Even if you claimed exemption from

the withholding for all future payments of

of allowances you are entitled to claim.

withholding on your federal Form W-4,

compensation. However, if you file the new

Give your completed Form IL-W-4 to your

U.S. Employee’s Withholding Allowance

form on September 1, your employer does

employer. Keep the worksheet for your

Certificate, because you do not expect

not have to change your withholding until

records.

to owe any federal income tax, you may

the first payment of compensation is made

be required to have Illinois Income Tax

If you have more than one job or

to you after October 1. If you file the new

withheld from your pay (see Publication

your spouse works, you should figure the

form on September 2, your employer does

130, Who is Required to Withhold Illinois

total number of allowances you are en-

not have to change your withholding until

Income Tax). If you are claiming exempt

titled to claim. Your withholding usually will

the first payment of compensation made to

status from Illinois withholding, you must

be more accurate if you claim all of your

you after December 31.

check the exempt status box on Form

allowances on the Form IL-W-4 for the

IL-W-4 and sign and date the certificate.

highest-paying job and claim zero on all of

How long is Form IL‑W‑4 valid?

Do not complete Lines 1 through 3.

your other IL-W-4 forms.

Your Form IL-W-4 remains valid until a

If you are a resident of Iowa, Kentucky,

What if I underpay my tax?

new form you have filed takes effect or

Michigan, or Wisconsin, or a military

until your employer is required by the

If the amount withheld from your com-

spouse, see Form W-5-NR, Employees

department to disregard it. Your employer

pensation is not enough to cover your

Statement of Nonresidence in Illinois, to

is required to disregard your Form IL-W-4

determine if you are exempt.

tax liability for the year, (e.g., you have

if you claim total exemption from Illinois

non-wage income, such as interest or

If you do not file a completed Form

Income Tax withholding, but you have not

dividends), you may reduce the number of

IL-W-4 with your employer, if you fail to

filed a federal Form W-4 claiming total

allowances or request that your employer

sign the form or to include all necessary

exemption. Also, if the Internal Revenue

withhold an additional amount from your

information, or if you alter the form, your

Service (IRS) has instructed your em-

pay. Otherwise, you may owe additional

employer must withhold Illinois Income Tax

ployer to disregard your federal Form W-4,

tax at the end of the year. If you do not

on the entire amount of your compensa-

your employer must also disregard your

have enough tax withheld from your pay,

tion, without allowing any exemptions.

Form IL-W-4. Finally, if you claim 15 or

and you owe more than $500 tax at the

more exemptions on your Form IL-W-4

When must I file?

end of the year, you may owe a late-pay-

without claiming at least the same number

ment penalty. You should either increase

You must file Form IL-W-4 when Illinois

of exemptions on your federal Form W-4,

the amount you have withheld from your

Income Tax is required to be withheld from

and your employer is not required to refer

pay, or you must make estimated tax pay-

compensation that you receive as an em-

your federal Form W-4 to the IRS for re-

ments.

ployee. You should complete this form and

view, your employer must refer your Form

You may be assessed a late‑payment

give it to your employer on or before the

IL-W-4 to the department for review. In that

penalty if your required estimated pay-

date you start working for your employer.

case, your Form IL-W-4 will be effective

ments are not paid in full by the due dates.

You may file a new Form IL-W-4 any time

unless and until the department notifies

your withholding allowances increase. If

You may still owe this penalty for an

your employer to disregard it.

the number of your previously claimed al-

earlier quarter, even if you pay enough tax

lowances decreases, you must file a new

What is an “exemption”?

later to make up the underpayment from a

Form IL-W-4 within 10 days. However, the

previous quarter.

An “exemption” is a dollar amount on

death of a spouse or a dependent does

For additional information on penalties,

which you do not have to pay Illinois

not affect your withholding allowances until

see Publication 103, Uniform Penal-

Income Tax. Therefore, your employer will

the next tax year.

ties and Interest. Visit our website at

withhold Illinois Income Tax based on your

tax.illinois.gov to obtain a copy.

compensation minus the exemptions to

When does my Form IL‑W‑4

which you are entitled.

take effect?

Where do I get help?

What is an “allowance”?

If you do not already have a Form IL-W-4

• Visit our website at tax.illinois.gov

on file with your employer, this form will be

The dollar amount that is exempt from

• Call our Taxpayer Assistance Division

effective for the first payment of compen-

Illinois Income Tax is based on the number

at 1 800 732‑8866 or 217 782‑3336

sation made to you after this form is filed.

of allowances you claim on this form. As

If you already have a Form IL-W-4 on file

• Call our TDD (telecommunications

an employee, you receive one allowance

with this employer, your employer may

device for the deaf) at 1 800 544‑5304

unless you are claimed as a dependent on

allow any change you file on this form to

another person’s tax return (e.g., your par-

• Write to

become effective immediately, but is not

ents claim you as a dependent on their tax

ILLINOIS DEPARTMENT OF REVENUE

required by law to change your withhold-

return). If you are married, you may claim

ing until the first payment of compensation

PO BOX 19044

additional allowances for your spouse and

any dependents that you are entitled to

SPRINGFIELD IL 62794‑9044

IL-W-4 (R-5/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3