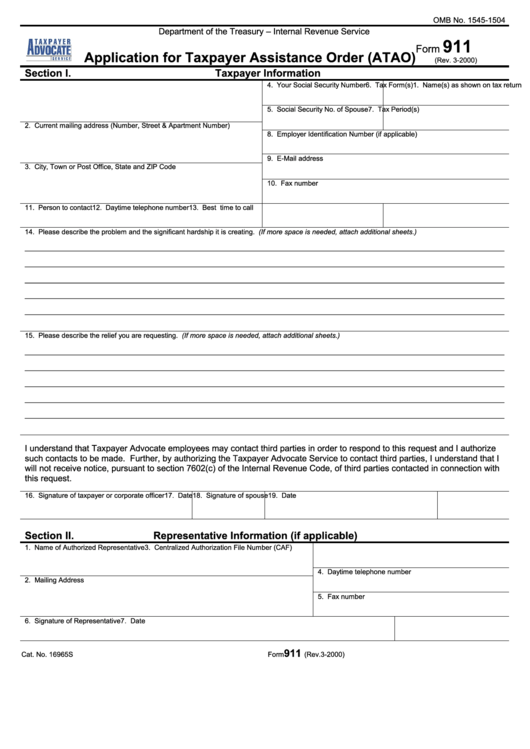

OMB No. 1545-1504

Department of the Treasury – Internal Revenue Service

911

Form

Application for Taxpayer Assistance Order (ATAO)

(Rev. 3-2000)

Section I.

Taxpayer Information

1. Name(s) as shown on tax return

4. Your Social Security Number

6. Tax Form(s)

5. Social Security No. of Spouse

7. Tax Period(s)

2. Current mailing address (Number, Street & Apartment Number)

8. Employer Identification Number (if applicable)

9. E-Mail address

3. City, Town or Post Office, State and ZIP Code

10. Fax number

11. Person to contact

12. Daytime telephone number

13. Best time to call

14. Please describe the problem and the significant hardship it is creating. (If more space is needed, attach additional sheets.)

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

15. Please describe the relief you are requesting. (If more space is needed, attach additional sheets.)

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

____________________________________________________________________________________________________________________________

I understand that Taxpayer Advocate employees may contact third parties in order to respond to this request and I authorize

such contacts to be made. Further, by authorizing the Taxpayer Advocate Service to contact third parties, I understand that I

will not receive notice, pursuant to section 7602(c) of the Internal Revenue Code, of third parties contacted in connection with

this request.

16. Signature of taxpayer or corporate officer

17. Date

18. Signature of spouse

19. Date

Section II.

Representative Information (if applicable)

1. Name of Authorized Representative

3. Centralized Authorization File Number (CAF)

4. Daytime telephone number

2. Mailing Address

5. Fax number

6. Signature of Representative

7. Date

911

Cat. No. 16965S

Form

(Rev. 3-2000)

1

1 2

2 3

3