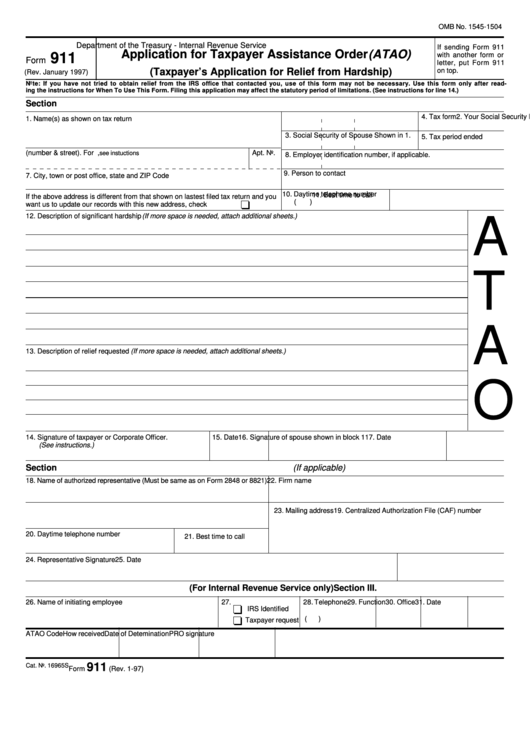

OMB No. 1545-1504

Department of the Treasury - Internal Revenue Service

If sending Form 911

Application for Taxpayer Assistance Order (ATAO)

911

with another form or

Form

letter, put Form 911

(Taxpayer’s Application for Relief from Hardship)

on top.

(Rev. January 1997)

Note: If you have not tried to obtain relief from the IRS office that contacted you, use of this form may not be necessary. Use this form only after read-

ing the instructions for When To Use This Form. Filing this application may affect the statutory period of limitations. (See instructions for line 14.)

Section I.

Taxpayer Information

2. Your Social Security Number

4. Tax form

1. Name(s) as shown on tax return

3. Social Security of Spouse Shown in 1.

5. Tax period ended

6.Current mailing address (number & street). For P.O. Box,

Apt. No.

see instuctions

8. Employer identification number, if applicable.

9. Person to contact

7. City, town or post office, state and ZIP Code

10. Daytime telephone number

11. Best time to call

If the above address is different from that shown on lastest filed tax return and you

(

)

want us to update our records with this new address, check here.......

12. Description of significant hardship (If more space is needed, attach additional sheets.)

A

T

A

13. Description of relief requested (If more space is needed, attach additional sheets.)

O

14. Signature of taxpayer or Corporate Officer.

15. Date

16. Signature of spouse shown in block 1

17. Date

(See instructions.)

Section II.

Representative Information (If applicable)

18. Name of authorized representative (Must be same as on Form 2848 or 8821)

22. Firm name

19. Centralized Authorization File (CAF) number

23. Mailing address

20. Daytime telephone number

21. Best time to call

24. Representative Signature

25. Date

Section III.

(For Internal Revenue Service only)

26. Name of initiating employee

27.

28. Telephone

29. Function 30. Office

31. Date

IRS Identified

(

)

Taxpayer request

ATAO Code

How received

Date of Detemination

PRO signature

911

Cat. No. 16965S

Form

(Rev. 1-97)

1

1 2

2