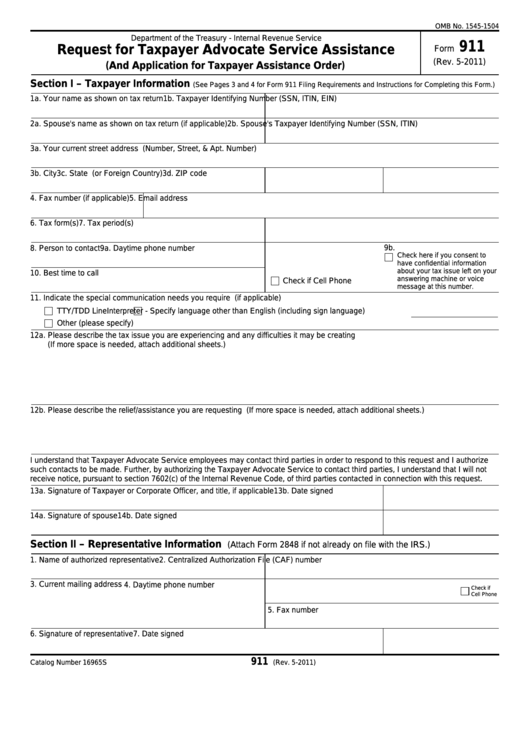

OMB No. 1545-1504

Department of the Treasury - Internal Revenue Service

911

Request for Taxpayer Advocate Service Assistance

Form

(Rev. 5-2011)

(And Application for Taxpayer Assistance Order)

Section I – Taxpayer Information

(See Pages 3 and 4 for Form 911 Filing Requirements and Instructions for Completing this Form.)

1a. Your name as shown on tax return

1b. Taxpayer Identifying Number (SSN, ITIN, EIN)

2a. Spouse's name as shown on tax return (if applicable)

2b. Spouse's Taxpayer Identifying Number (SSN, ITIN)

3a. Your current street address (Number, Street, & Apt. Number)

3b. City

3c. State (or Foreign Country)

3d. ZIP code

4. Fax number (if applicable)

5. Email address

6. Tax form(s)

7. Tax period(s)

9b.

8. Person to contact

9a. Daytime phone number

Check here if you consent to

have confidential information

about your tax issue left on your

10. Best time to call

answering machine or voice

Check if Cell Phone

message at this number.

11. Indicate the special communication needs you require (if applicable)

TTY/TDD Line

Interpreter - Specify language other than English (including sign language)

Other (please specify)

12a. Please describe the tax issue you are experiencing and any difficulties it may be creating

(If more space is needed, attach additional sheets.)

12b. Please describe the relief/assistance you are requesting (If more space is needed, attach additional sheets.)

I understand that Taxpayer Advocate Service employees may contact third parties in order to respond to this request and I authorize

such contacts to be made. Further, by authorizing the Taxpayer Advocate Service to contact third parties, I understand that I will not

receive notice, pursuant to section 7602(c) of the Internal Revenue Code, of third parties contacted in connection with this request.

13a. Signature of Taxpayer or Corporate Officer, and title, if applicable

13b. Date signed

14a. Signature of spouse

14b. Date signed

Section II – Representative Information

(Attach Form 2848 if not already on file with the IRS.)

1. Name of authorized representative

2. Centralized Authorization File (CAF) number

3. Current mailing address

4. Daytime phone number

Check if

Cell Phone

5. Fax number

6. Signature of representative

7. Date signed

911

Catalog Number 16965S

Form

(Rev. 5-2011)

1

1 2

2 3

3 4

4