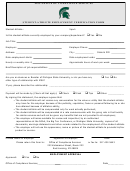

Student Business Travel Certification Form Page 2

ADVERTISEMENT

Student Travel and Tax Issues-Update

Page 2

II. FELLOWSHIP/SCHOLARSHIP/AWARD (FSA) PAYMENTS

A.

What Qualifies as a Fellowship/Scholarship/Award (FSA) Payment?

In most cases, an argument can be made that payments for student travel benefits both

the individual and the University. However, in order to determine the classification of

the payment, the primary beneficiary of the student payment must be identified as

follows:

•

Individual is primary beneficiary-facts show that the purpose for the payment is

for educational assistance to aid in the pursuit of study or independent research. Most

undergraduate awards and individual travel grants would typically fall into this category.

•

University is primary beneficiary-facts show the purpose of the payment is to

reimburse the individual for business expenses incurred on behalf of the University. The

University has a clear business interest in paying the student’s travel expenses (i.e., the

student is playing a leadership role at the conference attended, or is representing the

University at the conference, or attends the conference to support the faculty member’s

research (typically federal grant related)).

If the expense does not fall into one of the categories mentioned above as a business

expense (i.e., the examples discussed in I. A. above), it is likely an FSA payment because

the individual is the primary beneficiary of the payment. In these cases the facts indicate

that the primary purpose for the payment is for educational assistance to aid the student

in the pursuit of independent study or research.

B.

How to Report Fellowship/Scholarship/Awards (FSA) for Reimbursement

•

Request payment on a Check Requisition Form, unless:

o

Exception: If documentation is required for the FSA expense by the

sponsoring department, the payment may be requested through travelND .

Other Important Items to Note about FSA Payments:

•

If classified as a FSA, the recipient should be given a copy of the University’s

FSA letter found here:

procedures/documents/scholarship_fellowship_letter.pdf

•

Travel and expense reports submitted without the Student Certification Form

will be classified as a fellowship/scholarship/award (FSA) payment that may represent

taxable income to the student.

•

The University is not required to report FSA income on a year-end income tax

statement to students who are U.S. Persons (Citizens, U.S. Permanent residents,

Resident Aliens for tax purposes). However, FSA payments made to international

students who are nonresident aliens for tax purposes will be subject to withholding and

reporting on year-end tax statement Form 1042-S.

Student Travel and Tax Issues

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3