Student Business Travel Certification Form Page 3

ADVERTISEMENT

University of Notre Dame

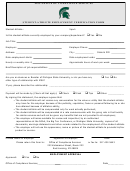

Student Business Travel Certification Form

A completed Student Business Travel Certification Form must be submitted with a travel expense

report when requesting reimbursement to a student for University business travel in order for the

payment to be made on a tax-free basis under the University’s Accountable Plan rules. Similar to

the method used for attaching other receipts, this form should be scanned and attached to the

student’s travel and expense report filed through travelND.

Name of Student ______________________________________________________

NDID or NetID_______________

Location and Dates of Travel: ____________________________________________________

I certify that these expenses (check all that apply):

____Directly supports a faculty member’s project or research program, or;

____Are related to presenting or leading a session at a conference (a photocopy of the conference

program is attached), or;

____Are incurred while officially representing the University

Note: The detailed business purpose for student travel must be described on the Travel and

Expense Report that this Certification Form is attached to.

If none of the above criteria are met, this form should not be completed and the reimbursement will

be classified as a fellowship/scholarship/award (FSA). The payment of FSA may represent taxable

income to the student (please give the student a copy of the University’s FSA letter) and may be

subject to withholding and reporting if paid to an international student.

__________________________________

____________________

Signature -Faculty member

Date

University of Notre Dame

Student Travel and Tax Issues

Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3