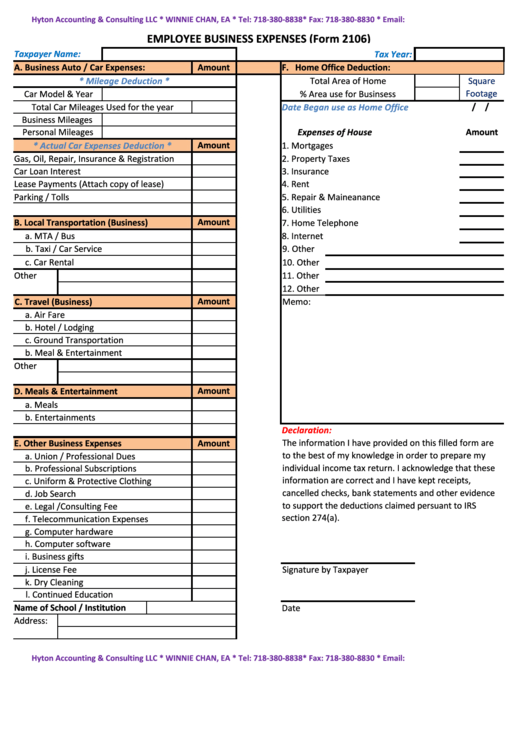

Hyton Accounting & Consulting LLC * WINNIE CHAN, EA * Tel: 718-380-8838* Fax: 718-380-8830 * Email:

EMPLOYEE BUSINESS EXPENSES (Form 2106)

Taxpayer Name:

Tax Year:

A. Business Auto / Car Expenses:

Amount

F. Home Office Deduction:

* Mileage Deduction *

Total Area of Home

Square

Footage

Car Model & Year

% Area use for Businsess

Total Car Mileages Used for the year

Date Began use as Home Office

/ /

Business Mileages

Personal Mileages

Expenses of House

Amount

Amount

* Actual Car Expenses Deduction *

1. Mortgages

Gas, Oil, Repair, Insurance & Registration

2. Property Taxes

Car Loan Interest

3. Insurance

Lease Payments (Attach copy of lease)

4. Rent

Parking / Tolls

5. Repair & Maineanance

6. Utilities

B. Local Transportation (Business)

Amount

7. Home Telephone

a. MTA / Bus

8. Internet

b. Taxi / Car Service

9. Other

c. Car Rental

10. Other

Other

11. Other

12. Other

Amount

C. Travel (Business)

Memo:

a. Air Fare

b. Hotel / Lodging

c. Ground Transportation

b. Meal & Entertainment

Other

Amount

D. Meals & Entertainment

a. Meals

b. Entertainments

Declaration:

The information I have provided on this filled form are

E. Other Business Expenses

Amount

to the best of my knowledge in order to prepare my

a. Union / Professional Dues

individual income tax return. I acknowledge that these

b. Professional Subscriptions

information are correct and I have kept receipts,

c. Uniform & Protective Clothing

cancelled checks, bank statements and other evidence

d. Job Search

to support the deductions claimed persuant to IRS

e. Legal /Consulting Fee

section 274(a).

f. Telecommunication Expenses

g. Computer hardware

h. Computer software

i. Business gifts

j. License Fee

Signature by Taxpayer

k. Dry Cleaning

l. Continued Education

Name of School / Institution

Date

Address:

Hyton Accounting & Consulting LLC * WINNIE CHAN, EA * Tel: 718-380-8838* Fax: 718-380-8830 * Email:

1

1