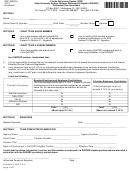

Il Substitute Forms Provider Enrollment 2015

ADVERTISEMENT

Illinois Department of Revenue

Substitute Forms Guidelines

2015

If you produce, or intend to produce, your own version of the official tax forms, you must follow the instructions

provided in this guide. Forms you produce are referred to in this guide as “substitute forms” and include returns,

schedules, and payment vouchers. Substitute forms providers may include software developers (primary or secondary),

payroll services, forms libraries, independent taxpayers, and other vendors of related services. NOTE: Substitute forms

that must be submitted to us for review and approval are forms you set up or to which you add a scan line or 2-D

barcode or alter in some way.

IMPORTANT: The substitute forms you produce must be processable through the Department’s automated processes.

The taxpayer may experience delays or be assessed penalties and interest for filing a form which does not meet our

requirements.

Required annual substitute forms process:

1. Complete Form IL-8633-SF, 2015 Substitute Forms Provider Enrollment, and submit it to us by September 30,

2015. Upon receipt of your completed Form IL-8633-SF, we will assign or confirm your Illinois vendor identification

number. We will also provide you a user ID and password you may use to access the secure “Draft Forms” area of

our website, where we post the substitute forms specifications and draft forms.

2. Developers of substitute forms must use the specifications for content and format in this guide and in the drafts and

examples provided in the secure “Draft Forms” area on our website.

3. Submit all substitute forms developed by emailing a PDF file to us. Occasionally for technical reasons, we may ask

you to mail a paper form to us. Each substitute form must be reviewed, and approved by us. Several forms require

a scan line or 2-D barcode containing taxpayer and other information (see our “Draft Forms” webpage for testing

specifications) and must also be tested. Some forms require a 1-D barcode. On test forms, the data used should not

contain “real” or “live” data. Forms received prior to December and after January will be reviewed and a response

sent within 10 business days. Forms received in the months of December and January will be reviewed and a

response sent within 15 business days. If your product simply provides an unaltered graphic image (picture) of the

Department’s form or copy printed from our public “Forms” webpage at tax.illinois.gov and it does not contain a

scan line or 2-D barcode, this form does not need review.

4. If we notify you of an error or correction, you must make the correction, notify your customers, and email evidence

of the correction to REV.VendorForms@illinois.gov within 10 days of receiving our notice.

Submit Form IL-8633-SF and all tax forms for review and testing, and contact us at the following:

email address: REV.VendorForms@illinois.gov

Mailing address: OFFICE OF PUBLICATIONS MANAGEMENT MC 3-375

phone: 217 557-3017

ILLINOIS DEPARTMENT OF REVENUE

fax: 217 524-0513

101 WEST JEFFERSON STREET

SPRINGFIELD IL 62702

Page 1

IL-8633-SF Guide (R-9/15) web only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4