Il Substitute Forms Provider Enrollment 2015 Page 2

ADVERTISEMENT

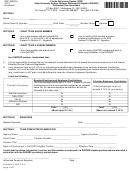

General format requirements for substitute forms

Paper

• Use white, unlined paper that is a standard business weight (recommended weight is 20 pound paper).

• Paper size must be the same size as the official forms. Most returns are 8.5 inches wide by 11 inches tall.

Vouchers are 8.5 inches wide by 3.625 inches tall.

Margin requirements

There must be at least a .25 or .5 inch margin on all sides of the form or voucher as described in each form’s

specifications. There must be a .25 inch band of white space around all sides of the barcode and scan line.

Data and layout requirements

Placement of form information and data should be at the location shown on the form samples located in the

secure “Draft Forms“ area of our website. Once we receive your completed Form IL-8633-SF, we will issue you

the user ID and password information to log into this area.

Printing Requirements

Forms and vouchers must be printed at the full size. Ensure that the “shrink to fit” print option is not selected.

Use black ink for data, scan line, 1-D barcode, and 2-D barcode.

Font

• For taxpayer data, use either Courier or Arial type fonts, size 12.

• For the scan line, use “OCR-A Std” font, size 10. All payment vouchers and some returns (Forms IL-941 and

ST-1) require a scan line containing taxpayer identification and reporting period information. See each draft

example for the contents and placement of the scan line.

• For the 1-D barcode, use “Free 3 of 9, Extended,” size 26. Most payment vouchers and forms require a 1-D

barcode. See each draft example for the 1-D barcode contents.

Ink color

Black ink is required for taxpayer data. No colored ink in the official IDOR form is required to be reproduced;

black ink may be substituted.

Shading and logos

Shading and logos are not required to be reproduced. If used, these should not interfere with the required

information contained on the form or voucher.

Number formatting

In dollar amount entries, do not add the dollar sign. For a zero amount, show 0.00. Complete the cents field

with two digits (example: fifty-five dollars and ten cents would show as 55.10). If the amount is a whole dollar

amount, print the whole number plus the decimal followed by 00 (example: one hundred dollars would show

as 100.00). Do not use default numbers in return lines which require the taxpayer to enter an amount.

Vendor identification number

You must add the vendor identification number we assign you to the footer area of your substitute Illinois tax

form.

Page 2

IL-8633-SF Guide (R-09/15) web only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4