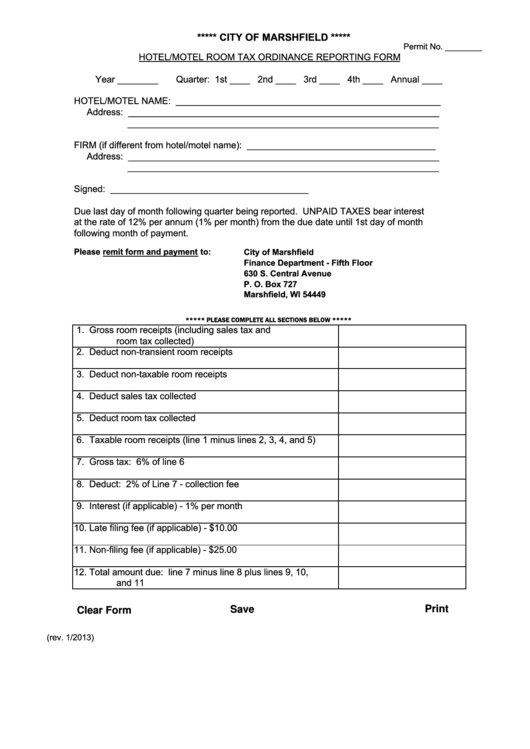

***** CITY OF MARSHFIELD *****

Permit No. ________

HOTEL/MOTEL ROOM TAX ORDINANCE REPORTING FORM

Year ________

Quarter: 1st ____ 2nd ____ 3rd ____ 4th ____ Annual ____

HOTEL/MOTEL NAME: ____________________________________________________

Address: _____________________________________________________________

_____________________________________________________________

FIRM (if different from hotel/motel name): _____________________________________

Address: _____________________________________________________________

_____________________________________________________________

Signed: _______________________________________

Due last day of month following quarter being reported. UNPAID TAXES bear interest

at the rate of 12% per annum (1% per month) from the due date until 1st day of month

following month of payment.

Please remit form and payment to:

City of Marshfield

Finance Department - Fifth Floor

630 S. Central Avenue

P. O. Box 727

Marshfield, WI 54449

***** PLEASE COMPLETE ALL SECTIONS BELOW *****

1. Gross room receipts (including sales tax and

room tax collected)

2. Deduct non-transient room receipts

3. Deduct non-taxable room receipts

4. Deduct sales tax collected

5. Deduct room tax collected

6. Taxable room receipts (line 1 minus lines 2, 3, 4, and 5)

7. Gross tax: 6% of line 6

8. Deduct: 2% of Line 7 - collection fee

9. Interest (if applicable) - 1% per month

10. Late filing fee (if applicable) - $10.00

11. Non-filing fee (if applicable) - $25.00

12. Total amount due: line 7 minus line 8 plus lines 9, 10,

and 11

Print

Save As...

Clear Form

(rev. 1/2013)

1

1