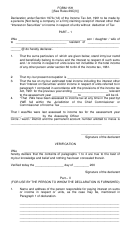

Form No. 2d - Income Tax Return Form For Noncorporate Assessees Other Than Persons Claiming Exemption Under Section 11 Page 2

ADVERTISEMENT

INSTRUCTION FOR FILLING UP SARAL (2D)

(These instructions are non-statutory)

1. SARAL Form is to be filled in duplicate. One copy is returned to the assessee after being duly acknowledged. With effect

from 01.6.1999, the acknowledgement is deemed to be the intimation. No intimation is separately given unless there is a

demand or refund.

2. All items should be filled in capital letters.

3. Status (Item No.6)- Please strike out whichever is not applicable.

4. Item no.13: Here, mention the name of the bank, the 9-digit MICR code, address of the bank branch, the type of account,

along with your account number. In case you want the refund, if any, to be credited directly into your bank account, fill in

‘Y’ in the box ‘ECS (Y/N)’, or else fill in ‘N’.

5. Income from house property (Item No.16)- Give the address of the property, its nature - whether let out or self occupied,

and the computation of net income shown against item no.16 in a separate annexure.

6. Income from business or profession (Item No.17)- Income from business or profession is required to be shown against this

item. Net income as appearing in your profit and loss or income and expenditure account is to be adjusted by disallowable

expenses, admissible claims not charged to the accounts, deemed income, etc. This has further to be adjusted by brought

forward losses/depreciation, if any, before being shown against item no.17. Attach separate annexure showing the

computation of income from business or profession. The income/ loss from speculation business should be shown

separately. Also attach trading, profit& loss account, balance sheet, etc., with enclosures including auditor’s certificate,

wherever required. Nature of business/ profession may also be indicated.

7. Capital gains (Item no.18)- Please show only net amount of capital gains against item no.18. The nature of the transferred

asset, its date of acquisition, date of transfer, cost of acquisition/ expenses, value of consideration, exemption of capital

gains, if any, and adjustment of brought forward losses, etc., should be indicated in a separate annexure.

l Capital gains are to be shown separately for short term and long-term. The assets held for more than 3 years (except

shares, units etc) are regarded as long term and others as short term. For shares, units etc., the period of holding for

long term is more than 12 months.

l The dates 15th September, 15th December, 15th March have ramifications on instalments of advance tax payable in

relation to capital gains. Therefore capital gains arising in each period (1.4.

to 14.9.___, 15.9.

to 15.12.

and thereafter) should be separately indicated against item no. 18).

8. Income from other sources (Item No.19)- Only net income from other sources such as interest, income from units, etc., to

be shown against this item. However, details of such income or expenses incidental thereto should be given in a separate

annexures.

9. Income of other persons (Item No.20)- Income of certain other persons like spouse or minor child is liable to be included

in your income as per provisions contained in Chapter -V of the Act.

10. Deductions under Chapter VI-A (Item No.22)- Total amount of deductions claimed should be shown section-wise against

this item. Detailed computation of deduction, if required, may be given in a separate annexure.

11. Income claimed to be exempt (Item No.25)- If you are claiming certain receipts as exempt from tax, please give full details

thereof in a separate annexure. Total amount of exemption claimed should be indicated against this item.

12. Tax on total income (Item No.26)- In the case of Individual/ HUF/AOP/BOI tax is charged for assessment year 2004-05 at

10% for income slab of Rs.50,000 - 60,000, 20% for income slab of Rs.60,001-1,50,000 and at 30% thereafter. Surcharge

is levied at the rate of 10% on the tax payable after allowing rebate under Part-A of Chapter VIII of the Income-tax Act on

income exceeding Rs.8,50,000/-. Tax rates for co-operative societies are at 10% for income upto Rs.10,000, 20% for

income between Rs.10,001-20,000 and 30% thereafter. Tax rate for Firms is 35% without any slab of income. In case of

co-operative societies and resident firms, the tax payable would be enhanced by a surcharge at the rate of 2½ % of the tax

payable. Special rates of tax are applicable on long term capital gains, @ 20% (10% where the asset is a listed security)

under section 112, on income by way of winnings from lotteries, crossword puzzles, games, gambling, betting, horse race,

etc., @ 30% under section 115BB. Details of income subjected to special rates should be shown in a separate annexure.

13. Rebate (Item No.27)/Relief (Item No.31)- Please indicate the tax rebate available as per section 88 of Income-tax Act,

1961.

For individuals who are aged 65 years or more, a rebate of 100% tax (subject to the maximum of Rs.20,000) is available

under section 88B for assessment year 2004-2005.

For individuals being resident woman, who are aged below 65 years, a rebate of 100% tax (subject to the maximum of

Rs.5,000) is available under section 88C

Relief is available under section 89/90/91.

14. Taxes deducted/paid (Item No.33 and 34)- Please attach proof of taxes paid.

15. Interest payable (Item No.35)- Interest is charged under section 234A for late filling of return, under section 234B for

shortfall in payment of advance tax and under section 234C for deferment of instalments of advance tax. Please show such

interest separately. Please note that interest chargeable under section 234A, 234B and 234C is at the rate of one percent

with effect from 08.9.2003 onwards.

16. Item No.36: For self assessment tax paid on or before 31.5.2004, (a) should be filled up, and a copy of the challan should

be attached with the return. For self assessment tax paid after 31.5.2004, table at (b) should be filled up. Copy of

acknowledgement counterfoil (in respect of self assessment tax paid after 31.5.04) is not required to be attached, however,

from the counterfoil, the name of the bank branch, BSR Code of the Bank Branch (7 digit), date of deposit, challan serial

no., and amount of tax paid should be filled up.

Printed from

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2