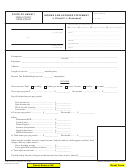

Day Care Provider Income And Expense Worksheet Template Page 3

ADVERTISEMENT

Alert To All Day Care Providers

Audits

1.

are always possible, so be prepared and accurate. If the

IRS informs you of an audit in writing, send the notice to us. If the

IRS calls you to schedule an audit, be sure to exercise your

constitutional rights, and inform them you want representation. Get

their name, ID number and phone number, then call us.

Hours

2.

-Be accurate on reporting your hours of operation, no

guessing or approximations can be used. We will add on the new

extra hours available to be added to your actual hours available.

New Home?

3.

-If you moved during the year, you will be required

to prepare two business returns based upon income and expenses

per each location. Call the office to discuss this as you will need

more time for your appointment.

Meals

4.

- Do not assume the days and meals served, count them!

If audited and you guessed wrong, your whole meal deduction could

be disallowed.

5. 100% Day Care Use- Notice the left side of Page 2 of the

daycare sheet is for items that are used exclusively for daycare.

6. Shared Expenses- Notice the right side of Page 2 lists those

items you share with daycare. If you do not separate items like

household supplies, cleaning supplies, kitchen supplies, bottle water,

etc., then you will list the total expenses here and we will allocate.

7. Square Footage Use- New court ruling states you need to deduct

the space of non-100% rooms. This means unless your bedroom

and or any of your children rooms are not used regularly for the

daycare you cannot use the space. Measure the rooms and the total

needs to be subtracted from your total home square footage.

8. Use the following to complete those large 100% day care items:

DATE

COST

DATE

COST

Computer

_______

_______

Fencing

_______

______

Swing Set

_______

_______

Television _______

______

Furniture

_______

_______

Other ___________

______

Be sure to call the office, or e-mail your questions to us any time one

arises. It is much better to have answers prior to spending time to

doing something incorrect. If you need more time to get your records

in proper order, please call for a schedule change; otherwise, see you

at our meeting.

Lake Stevens Tax 425-334-8138

OR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3