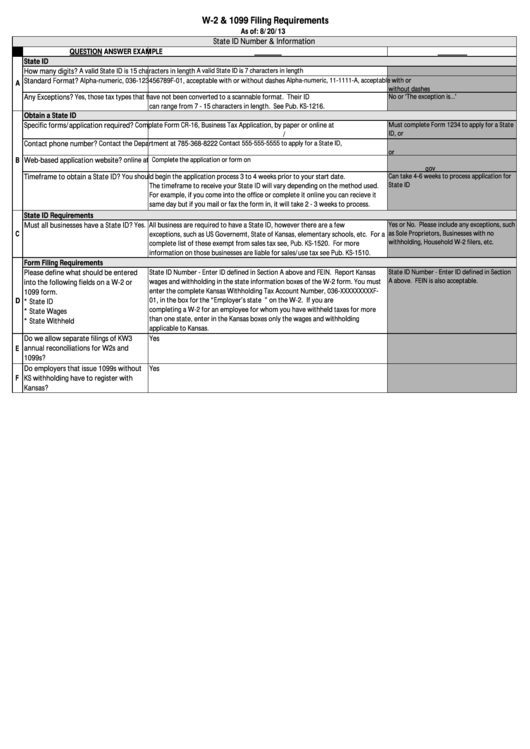

W-2 & 1099 Filing Requirements (2013)

ADVERTISEMENT

W-2 & 1099 Filing Requirements

As of: 8/20/13

State ID Number & Information

QUESTION

ANSWER

EXAMPLE

State ID

A valid State ID is 7 characters in length

How many digits?

A valid State ID is 15 characters in length

Standard Format?

Alpha-numeric, 036-123456789F-01, acceptable with or without dashes

Alpha-numeric, 11-1111-A, acceptable with or

A

without dashes

Yes, those tax types that have not been converted to a scannable format. Their ID

No or 'The exception is…'

Any Exceptions?

can range from 7 - 15 characters in length. See Pub. KS-1216.

Obtain a State ID

Specific forms/application required?

Complate Form CR-16, Business Tax Application, by paper or online at

Must complete Form 1234 to apply for a State

ID, or

https://

Contact 555-555-5555 to apply for a State ID,

Contact phone number?

Contact the Department at 785-368-8222

or

Web-based application website?

online at https://

Complete the application or form on

B

Timeframe to obtain a State ID?

You should begin the application process 3 to 4 weeks prior to your start date.

Can take 4-6 weeks to process application for

State ID

The timeframe to receive your State ID will vary depending on the method used.

For example, if you come into the office or complete it online you can recieve it

same day but if you mail or fax the form in, it will take 2 - 3 weeks to process.

State ID Requirements

Must all businesses have a State ID?

Yes. All business are required to have a State ID, however there are a few

Yes or No. Please include any exceptions, such

C

as Sole Proprietors, Businesses with no

exceptions, such as US Governemt, State of Kansas, elementary schools, etc. For a

withholding, Household W-2 filers, etc.

complete list of these exempt from sales tax see, Pub. KS-1520. For more

information on those businesses are liable for sales/use tax see Pub. KS-1510.

Form Filing Requirements

State ID Number - Enter ID defined in Section A above and FEIN. Report Kansas

State ID Number - Enter ID defined in Section

Please define what should be entered

A above. FEIN is also acceptable.

wages and withholding in the state information boxes of the W-2 form. You must

into the following fields on a W-2 or

enter the complete Kansas Withholding Tax Account Number, 036-XXXXXXXXXF-

1099 form.

D

01, in the box for the “Employer’s state I.D. number” on the W-2. If you are

* State ID

completing a W-2 for an employee for whom you have withheld taxes for more

* State Wages

than one state, enter in the Kansas boxes only the wages and withholding

* State Withheld

applicable to Kansas.

Do we allow separate filings of KW3

Yes

annual reconciliations for W2s and

E

1099s?

Do employers that issue 1099s without

Yes

F

KS withholding have to register with

Kansas?

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2